Here at Srilanka Share Market, we’re on a mission to provide first hand information to those who are willing to invest or trade in Colombo Stock Exchange. Also heading into share market could be scary, but we SriLanka Share Market turn that fear into fun by providing educational, research materials from respectable sources.

Tuesday, 31 May 2016

Quote for the day

“Once you have mastered time, you will understand how true it is that most people overestimate what they can accomplish in a year – and underestimate what they can achieve in a decade.” – Tony Robbins

Monday, 30 May 2016

Quote for the day

"If you want to make a permanent change, stop focusing on the size of your problems and start focusing on the size of you!" - T. Harv Eker

Sunday, 29 May 2016

Saturday, 28 May 2016

Quote for the day

"You have to be burning with an idea, or a problem, or a wrong that you want to right. If you're not passionate enough from the start, you'll never stick it out." - Steve Jobs

Friday, 27 May 2016

Quote for the day

“Anything outside yourself, this you can see and apply your logic to it. But it's a human trait that when we encounter personal problems, these things most deeply personal are the most difficult to bring out for our logic to scan. We tend to flounder around, blaming everything but the actual, deep-seated thing that's really chewing on us.” - Lady Jessica

Thursday, 26 May 2016

Quote for the day

"Value investing is relevant in all circumstances. But thought processes and principles are dynamic and not static. Be open to change." - Rakesh Jhunjhunwala

Wednesday, 25 May 2016

Quote for the day

"If you don't design your own life plan, chances are you'll fall into someone else's plan. And guess what they have planned for you? Not much." - Jim Rohn

Tuesday, 24 May 2016

Quote for the day

“The secret of success is learning how to use pain and pleasure instead of having pain and pleasure use you. If you do that, you’re in control of your life. If you don’t, life controls you.” – Tony Robbins

Monday, 23 May 2016

Quote for the day

"A man can be as great as he wants to be. If you believe in yourself and have the courage, the determination, the dedication, the competitive drive and if you are willing to sacrifice the little things in life and pay the price for the things that are worthwhile, it can be done." - Vince Lombardi

Sunday, 22 May 2016

7 Bad Habits Preventing You From Making More Money

By Jason Demers

Are any of these common habits putting a stubborn limit on the amount of money you earn?

Not all of us are materialistic, but we can probably all agree that making more money is a good thing. It's true that setting a strict budget, cutting your expenses, and saving more money can go a long way in maximizing your personal financial growth, but these strategies pale in comparison to one major variable in your life--your income. Everything else being equal, making more money makes life easier.

Most people realize this, but so many neglect certain fundamentals and throttle their income potential. For example, take these seven stifling habits that could put a stubborn limit on the amount of money you make:

Are any of these common habits putting a stubborn limit on the amount of money you earn?

Not all of us are materialistic, but we can probably all agree that making more money is a good thing. It's true that setting a strict budget, cutting your expenses, and saving more money can go a long way in maximizing your personal financial growth, but these strategies pale in comparison to one major variable in your life--your income. Everything else being equal, making more money makes life easier.

Most people realize this, but so many neglect certain fundamentals and throttle their income potential. For example, take these seven stifling habits that could put a stubborn limit on the amount of money you make:

Quote for the day

"Develop success from failures. Discouragement and failure are two of the surest stepping stones to success." - Dale Carnegie

Saturday, 21 May 2016

13 Top Billionaires’ Tips on Positive Thinking—and Why It Matters

By Nick Bastion

In popular culture, people know that they are supposed to “think positive.” We all sort of know that we should scotch-tape affirmations to our bathroom mirrors and say “I love you” to ourselves, and keep our chins up (presumably while reading those mirror-stuck affirmations)

But why?

In popular culture, people know that they are supposed to “think positive.” We all sort of know that we should scotch-tape affirmations to our bathroom mirrors and say “I love you” to ourselves, and keep our chins up (presumably while reading those mirror-stuck affirmations)

But why?

Quote for the day

"Success is liking yourself, liking what you do, and liking how you do it." - Maya Angelou

Friday, 20 May 2016

Quote for the day

"Successful investors are opportunistic and optimistic ones." - Rakesh Jhunjhunwala

Thursday, 19 May 2016

Quote for the day

"Experience never errs; it is only your judgments that err by promising themselves effects such as are not caused by your experiments." - Leonardo da Vinci

Wednesday, 18 May 2016

Quote for the day

"Passionate investors always make money in stock markets. You will never fail in any work if you do it with passion." - Rakesh Jhunjhunwala

Tuesday, 17 May 2016

Quote for the day

“Success is the good fortune that comes from aspiration, desperation, perspiration and inspiration.” - Evan Esar

Monday, 16 May 2016

Quote for the day

"Success is ... knowing your purpose in life, growing to reach your maximum potential, and sowing seeds that benefit others." - John C. Maxwell

Sunday, 15 May 2016

Trading Mantra - 50 Golden Rules for Successful Trading

- Divide your capital into 10 equal risk parts.

- Never over trade.

- Never place order for BUY/SELL without stop loss conditions.

- Never let profit turn into loss.

- Trade with the trend.

- Never take lead you may lose heavily.

- Never try to be over smart.

- Don’t trade if trend not clear

- Don’t follow tips only.

- Use the right orders only.

- Withdraw portion of profits.

- Don’t be whimsical about closing your trades.

- Never buy a stock to get dividend.

- Never average your losses.

- Take big profits and small losses.

- Sell short as often as you go long.

- Never buy any stock just it is low priced.

- Pyramid your trades correctly.

- Decrease your trading after a series of successful trades.

- Don’t change your opinions during market hours.

- Don’t follow the crowd – they are usually wrong.

- Buy on rumor and sell on news.

- Take windfall gains when you get.

- Keep your charts up to date.

- Preserve your capital.

- Nothing ever new occurs in market.

- Markets are never wrong opinion may be.

- Never permit speculative ventures to turn into investments.

- Never try to predetermine your profits.

- Never buy a stock just because it is low priced or don’t sell just because it is high priced.

- Look for reasonable profits.

- Buy as soon as a stock makes new highs after a normal reaction.

- Ban wishful thinking in the market.

- Leaders of today may not be leaders of tomorrow.

- Don’t be too cautious about reasons behind the moves.

- Trade only the active stocks.

- Bear markets have no support and bull markets have no resistance.

- The smarter you are the longer it takes.

- It is very hard to get out of a trade than to get in.

- Don’t talk about what you are doing in the market.

- When time is up, markets must reverse.

- Control what you can; manage what you cannot.

- Big movements take time to develop.

- A good trade is profitable right from the start. If you cannot make money trading the leading issues you cannot make it trading the overall market.

- Avoid partnership in trading accounts.

- The human side of every person is the greatest enemy of successful trading.

- Money cannot be made every day in the market.

- As long as market is acting right don’t rush to take profits.

- Never buy a stock just because it has fallen from a great high, nor sell a stock because it is high priced.

http://futurebasedinvestment.com/trading-mantra/

Quote for the day

"When you stop chasing the wrong things, you give the right things a chance to catch you." - Lolly Daskal

Saturday, 14 May 2016

10 Top Traits All Billionaire Entrepreneurs Have in Common

While many of the world's wealthiest people have earned their riches in drastically different ways, they all share these valuable traits.

By Jake Newfield

What separates the successful from the extremely successful? Is it just a difference of luck, or a convenient uptick in the market?

Did Mark Zuckerberg earn his wealth merely by stumbling onto the newest media trend, or is there something deeper and more meaningful that creates a billionaire?

After examining and interviewing over 35 billionaires, the commonalities are shocking. While many of the world's wealthiest people have earned their riches in drastically different ways, they all share 10 traits. Whether their success came from technology, oil, investments, or retail - these 10 traits hold through in every single case.

Which traits do you have?

1. Insatiable desire for money and success

It's hard to satisfy a billionaire, and it was especially hard to satisfy them before they reached their pinnacle of wealth. Complacency and content are two of the most dangerous traits for someone who wants to accumulate wealth. By always striving for more, billionaires are able to achieve their success.

2. Entrepreneurial mindset

Becoming a billionaire starts with thinking like one. The billionaires we spoke with emphasized their inclination towards finding their own path, creating their vision, and growing it to become a reality. Being able to blaze your own trail and create solutions is part of what billionaires attribute to their success.

4. Empathic Ability

Successful people can make friends with anyone.

To execute deals and grow business, you need to be able to get along with people. Even further - you need to be able to connect with people and get them to favor you. A billionaire's ability to persuade and communicate with other people is pivotal to their ability to succeed.

5. Creativity

New money doesn't come from old ideas.

All billionaires have the ability to innovate, to create new ideas, and to take common ideas and turn them inside-out. This comes from finding problems, understanding consumers, and creating solutions to problems.

6. Ability to Motivate Others

Being successful requires a talented team to back you up.

There is no person to ever make billions of dollars without the help of other people. If you can motivate others to help you achieve your goals, you will be able to go immensely further than you would alone.

7. Constant Dissatisfaction

People who achieve satisfaction easily tend to be complacent. If you are always dissatisfied, then you are always trying to improve, to make more money, to be better.

The billionaires today didn't spend a week celebrating when they made their first million. They put the money in the bank and went back to work.

8. Willingness to Take Risks

Rarely is the winning lottery ticket handed to you.

Every billionaire has had to take a big risk at one point in his career. Elon Musk is known for investing all of his earnings from PayPal into Tesla and SpaceX, and in doing so risked everything. Yet in doing so, he put himself in a position to make a lot more money than he ever had before.

9. Coachability & Hyperfocus

Nobody is born with the ability to do everything on their own.

To be successful, you need to learn the basics from other people, and find mentors who appeal to your goals. At the same time, billionaires are able to hyper-focus on one task or one goal at a time, until that goal is completed.

10. Big-Picture thinking

Big ideas require big-picture thinking. Billionaires are dreamers whose willingness to win is strong enough for them to fight through every obstacle in their way.

Source: www.inc.com

By Jake Newfield

What separates the successful from the extremely successful? Is it just a difference of luck, or a convenient uptick in the market?

Did Mark Zuckerberg earn his wealth merely by stumbling onto the newest media trend, or is there something deeper and more meaningful that creates a billionaire?

After examining and interviewing over 35 billionaires, the commonalities are shocking. While many of the world's wealthiest people have earned their riches in drastically different ways, they all share 10 traits. Whether their success came from technology, oil, investments, or retail - these 10 traits hold through in every single case.

Which traits do you have?

1. Insatiable desire for money and success

It's hard to satisfy a billionaire, and it was especially hard to satisfy them before they reached their pinnacle of wealth. Complacency and content are two of the most dangerous traits for someone who wants to accumulate wealth. By always striving for more, billionaires are able to achieve their success.

2. Entrepreneurial mindset

Becoming a billionaire starts with thinking like one. The billionaires we spoke with emphasized their inclination towards finding their own path, creating their vision, and growing it to become a reality. Being able to blaze your own trail and create solutions is part of what billionaires attribute to their success.

3. Relentless Work Ethic

Billionaires aren't made overnight.

Whether you have a great idea or the means to accomplish it, creating enormous wealth takes an equally enormous amount of effort sustained over a long time. Persistence and devoted energy over a sustained period of time is necessary to see your dream through fruition.

Billionaires aren't made overnight.

Whether you have a great idea or the means to accomplish it, creating enormous wealth takes an equally enormous amount of effort sustained over a long time. Persistence and devoted energy over a sustained period of time is necessary to see your dream through fruition.

4. Empathic Ability

Successful people can make friends with anyone.

To execute deals and grow business, you need to be able to get along with people. Even further - you need to be able to connect with people and get them to favor you. A billionaire's ability to persuade and communicate with other people is pivotal to their ability to succeed.

5. Creativity

New money doesn't come from old ideas.

All billionaires have the ability to innovate, to create new ideas, and to take common ideas and turn them inside-out. This comes from finding problems, understanding consumers, and creating solutions to problems.

6. Ability to Motivate Others

Being successful requires a talented team to back you up.

There is no person to ever make billions of dollars without the help of other people. If you can motivate others to help you achieve your goals, you will be able to go immensely further than you would alone.

7. Constant Dissatisfaction

People who achieve satisfaction easily tend to be complacent. If you are always dissatisfied, then you are always trying to improve, to make more money, to be better.

The billionaires today didn't spend a week celebrating when they made their first million. They put the money in the bank and went back to work.

8. Willingness to Take Risks

Rarely is the winning lottery ticket handed to you.

Every billionaire has had to take a big risk at one point in his career. Elon Musk is known for investing all of his earnings from PayPal into Tesla and SpaceX, and in doing so risked everything. Yet in doing so, he put himself in a position to make a lot more money than he ever had before.

9. Coachability & Hyperfocus

Nobody is born with the ability to do everything on their own.

To be successful, you need to learn the basics from other people, and find mentors who appeal to your goals. At the same time, billionaires are able to hyper-focus on one task or one goal at a time, until that goal is completed.

10. Big-Picture thinking

Big ideas require big-picture thinking. Billionaires are dreamers whose willingness to win is strong enough for them to fight through every obstacle in their way.

Source: www.inc.com

Quote for the day

“Most people easily grasp the immediate impact of developments, but few understand the 'second-order' consequences... as well as the third and fourth. When these latter factors come to be reflected in asset prices, this is often referred to as 'contagion.'” - Howard Marks

Friday, 13 May 2016

Quote for the day

“Many fail to grasp what they have seen, and cannot judge what they have learned, although they tell themselves they know.” - Heraclitus

Thursday, 12 May 2016

Quote for the day

“Volatility is greatest at turning points, and diminishes as a [new] trend is established.” - George Soros

Wednesday, 11 May 2016

Quote for the day

“Since investors are human and make mistakes, they're never 100% sure of their vision and whether or not their view is correct. So price adjustments take time as they fluctuate and a new consensus is formed in the face of changing market conditions and new facts. For some changes this consensus is easy to reach, but there are other events that take time to formulate a market view. It's those events that take time that form the basis of our profits.” - John W. Henry

Tuesday, 10 May 2016

Quote for the day

"Focus on the journey, not the destination. Joy is found not in finishing an activity but in doing it." - Greg Anderson

Monday, 9 May 2016

Quote for the day

"You have to be burning with an idea, or a problem, or a wrong that you want to right. If you're not passionate enough from the start, you'll never stick it out." - Steve Jobs

Sunday, 8 May 2016

13 Things Successful Traders Do Differently

1. They pursue realistic goals as their returns.

3. They focus on winning trades and not quantity of trades.

4. They make logical, informed trading decisions within their system, based on the

probabilities.

5. They avoid the trap of trying to make perfect trades, and instead focus on being profitable in the long term.

6. They trade the right position size that is within their comfort zone.

7. They keep things simple and focus on winning trades, not complexity in their trading.

8. They focus on learning and making small continuous improvements in their trading system.

9. They measure and track their progress with a trading journal.

10. They maintain a positive outlook as they learn from their mistakes, and focus on trading with discipline.

11. They spend time learning from better traders.

13. They love what they do and their passion keeps them going through the rough times.

2. They take decisive and immediate action when their buy or sell signal is hit.

3. They focus on winning trades and not quantity of trades.

4. They make logical, informed trading decisions within their system, based on the

probabilities.

5. They avoid the trap of trying to make perfect trades, and instead focus on being profitable in the long term.

6. They trade the right position size that is within their comfort zone.

7. They keep things simple and focus on winning trades, not complexity in their trading.

8. They focus on learning and making small continuous improvements in their trading system.

9. They measure and track their progress with a trading journal.

10. They maintain a positive outlook as they learn from their mistakes, and focus on trading with discipline.

11. They spend time learning from better traders.

12. They maintain balance in their life by spending time with family and friends.

13. They love what they do and their passion keeps them going through the rough times.

Source: www.new traderu.com

Quote for the day

"Much of the stress that people feel doesn't come from having too much to do. It comes from not finishing what they've started." - David Allen

Saturday, 7 May 2016

5 Habits That Will Guarantee Your Failure in Life

By Thomas Oppong

Your daily habits define who you are. You are practically what you do. In the words of Winston Churchill: "Success is not final, failure is not fatal -- it is the courage to continue that counts." If you have ever failed in the past but never gave up, you are stronger than you think.

If you have failed recently and are considering giving up, don't. The obstacle is definitely the way. There will always be a way out. You just haven't found it yet. Keep on trying. Find out why and how you got stuck, and dig yourself out of the temporary setback. Unfortunately, most people refuse to do something about their failures. In the end, they give up on their dreams and stop working on projects that matter to them and continue to wallow in discontent.

Everyone fears to fail, experiencing it is inevitable, but it's your response to it that makes all the difference. Don't get stuck. You are not your failure. These are a few of the many habits that could guarantee your failure -- and what you can do about them.

1. Failing to plan

You have a better chance to succeed in life if you have a plan. It doesn't have to be perfect. The real world doesn't reward perfectionists but those who get stuff done. You should always think through whatever you want to achieve and make plans on what to do next at any point in time. You plans should be specific, measurable and time-bound. A complete big picture prepares you for execution. Don't make vague plans. You will be prone to procrastinate if your plan is not measurable. Work with timelines for better and faster results.

2. The fear to even try

"You miss 100 percent of the shots you don't take." Wayne Gretzky could not have said that any better. You can only make progress if you take a step. Overcoming the fear of failing is the first step towards success. Start confronting your fears today. And take even the most basic step towards what you have to do. Remember the dream you were too scared to chase? It’s still not too late to give it a try. Never miss an opportunity to try.

"No matter how many mistakes you make, or how slow you progress, you are still way ahead of everyone who isn’t trying." -- Tony Robbins.

3. Giving up too soon

How persistent are you about pursuing your dreams and goals in life? One of the most important secrets of success is learning to conquer your doubts. Most of us give up on our passion too soon. Every successful person you know today has a perseverance story to share. There is probably no better example of persistence than the story of Abraham Lincoln.

He failed in business at 21, lost a legislative race at age 22, failed in business again at 24 and lost a congressional race when he was 34. At 45 he lost a senatorial race. And he failed in an attempt to become Vice President when he was 47. But he was finally elected President of the United States at age 52. Lincoln never quit. He could have given up after several attempts but pursued his ambition to assume the highest office in America. There is no substitute for persistence. As long as you are still actively trying after every failure, you have not failed yet.

4. Disbelief

If you don't believe in what you do, you will give up at some point. If you have no reason to believe it's possible to achieve your dreams or goals, all the effort you are putting into it will be wasted. You mind’s unconscious beliefs plays a significant role in the amount of effort you put into your life's work. If you don't see a successful outcome, you won't push yourself further to get there. Your progress depends on your decision to try knowing that you will overcome your failures and rise above them.

5. Making excuses

There will always be a reason why it can't be done. People constantly explain away why they couldn’t, shouldn’t, didn’t, or simply wouldn’t do something. When you make excuses, you are simply saying, “I’m not in control.” But guess what -- you are the only person who is fully in control of your actions and decisions in the world. Making excuses robs you of your personal power.

People make excuses because of the fear of the unknown. Others are just afraid of change, rejection and embarrassment. Fear locks you in your comfort zone. And nothing magical or remarkable happens in your safe zone. You can stop making excuses if you learn how to eliminate all traces of fear from your life. The next time you experience a setback, don't make an excuse. See it as a challenge, learn from it and move on. Excuses are distractions, and they reduce your confidence and self-belief. You don't want that -- especially when you still have a lot to show the world.

Your daily habits define who you are. You are practically what you do. In the words of Winston Churchill: "Success is not final, failure is not fatal -- it is the courage to continue that counts." If you have ever failed in the past but never gave up, you are stronger than you think.

If you have failed recently and are considering giving up, don't. The obstacle is definitely the way. There will always be a way out. You just haven't found it yet. Keep on trying. Find out why and how you got stuck, and dig yourself out of the temporary setback. Unfortunately, most people refuse to do something about their failures. In the end, they give up on their dreams and stop working on projects that matter to them and continue to wallow in discontent.

Everyone fears to fail, experiencing it is inevitable, but it's your response to it that makes all the difference. Don't get stuck. You are not your failure. These are a few of the many habits that could guarantee your failure -- and what you can do about them.

1. Failing to plan

You have a better chance to succeed in life if you have a plan. It doesn't have to be perfect. The real world doesn't reward perfectionists but those who get stuff done. You should always think through whatever you want to achieve and make plans on what to do next at any point in time. You plans should be specific, measurable and time-bound. A complete big picture prepares you for execution. Don't make vague plans. You will be prone to procrastinate if your plan is not measurable. Work with timelines for better and faster results.

2. The fear to even try

"You miss 100 percent of the shots you don't take." Wayne Gretzky could not have said that any better. You can only make progress if you take a step. Overcoming the fear of failing is the first step towards success. Start confronting your fears today. And take even the most basic step towards what you have to do. Remember the dream you were too scared to chase? It’s still not too late to give it a try. Never miss an opportunity to try.

"No matter how many mistakes you make, or how slow you progress, you are still way ahead of everyone who isn’t trying." -- Tony Robbins.

3. Giving up too soon

How persistent are you about pursuing your dreams and goals in life? One of the most important secrets of success is learning to conquer your doubts. Most of us give up on our passion too soon. Every successful person you know today has a perseverance story to share. There is probably no better example of persistence than the story of Abraham Lincoln.

He failed in business at 21, lost a legislative race at age 22, failed in business again at 24 and lost a congressional race when he was 34. At 45 he lost a senatorial race. And he failed in an attempt to become Vice President when he was 47. But he was finally elected President of the United States at age 52. Lincoln never quit. He could have given up after several attempts but pursued his ambition to assume the highest office in America. There is no substitute for persistence. As long as you are still actively trying after every failure, you have not failed yet.

4. Disbelief

If you don't believe in what you do, you will give up at some point. If you have no reason to believe it's possible to achieve your dreams or goals, all the effort you are putting into it will be wasted. You mind’s unconscious beliefs plays a significant role in the amount of effort you put into your life's work. If you don't see a successful outcome, you won't push yourself further to get there. Your progress depends on your decision to try knowing that you will overcome your failures and rise above them.

5. Making excuses

There will always be a reason why it can't be done. People constantly explain away why they couldn’t, shouldn’t, didn’t, or simply wouldn’t do something. When you make excuses, you are simply saying, “I’m not in control.” But guess what -- you are the only person who is fully in control of your actions and decisions in the world. Making excuses robs you of your personal power.

People make excuses because of the fear of the unknown. Others are just afraid of change, rejection and embarrassment. Fear locks you in your comfort zone. And nothing magical or remarkable happens in your safe zone. You can stop making excuses if you learn how to eliminate all traces of fear from your life. The next time you experience a setback, don't make an excuse. See it as a challenge, learn from it and move on. Excuses are distractions, and they reduce your confidence and self-belief. You don't want that -- especially when you still have a lot to show the world.

Source: www.entrepreneur.com

Quote for the day

“I know that to be successful, I have to be frightened. My biggest hits have always come after I have had a great period and I started to think that I knew something.” - Paul Tudor Jones

Friday, 6 May 2016

Quote for the day

“Optimism is the faith that leads to achievement. Nothing can be done without hope and confidence.” - Helen Keller

Thursday, 5 May 2016

Quote for the day

“Very often, people confuse simple with simplistic. The nuance is lost on most.” - Clement Mok

Wednesday, 4 May 2016

Quote for the day

“Discipline is number one: Take a theory and stick with it. But you also have to be open-minded enough to switch tracks if you feel that your theory has been proven wrong. You have to be able to say, 'My method worked for this type of market, but we are not in that type of market anymore.'” - Tony Saliba

Tuesday, 3 May 2016

Quote for the day

“Bears can only make money if the bulls push up stocks to where they are overpriced and unsound.” - Bernard Baruch

Monday, 2 May 2016

Sri Lanka Is Intriguing: Areas To Consider For Value Investing

By Dylan Waller

Summary

* Sri Lanka is geographically poised to benefit due to its strategic location on the Indian Ocean, where it operates multiple ports. Its SAGT port ranked 4th globally for productivity.

* Specific opportunities can be found in these areas: Tea exporting, tourism, distilleries, healthcare, banking, and select areas of manufacturing.

* Sri Lanka's Civil War ended in 2009, and the country's improved political landscape has been a catalyst for improved economics.

Opportunity Overview

The stock market discount and comparatively stronger trends of growth present in frontier Asia is intriguing, and a buy frontier, sell emerging approach is one of the most clear cut ways to prosper when investing in Asia. These trends, coupled with noteworthy political improvements, can be combined to create a strong value investing case. Sri Lanka is a strong frontier market in Asia that meets all of these requirements, yet is being relegated by many foreign investors. Sri Lanka has been benefiting from the end of the country's 26-year civil war that ended in 2009, which has produced a much more favourable political landscape. This improvement has been coupled with Sri Lanka's new government, which was elected in January 2015. On top of this, the country has been experiencing rapid growth in consumption, and has some interesting investment opportunities found in areas such as banking, healthcare, tea exporting companies, construction, manufacturing, logistics, and consumer goods. The country of 21 million has comparatively lower wages, and a literacy rate of 92%, the highest in South Asia, and among the highest in Asia. However, the most salient, and overlooked opportunity, is the country's strategic geographical placement on the Indian Ocean, allowing it to be strong economic centre for logistics. This strategic benefit will be modestly complemented by other strong trends, and allow Sri Lanka to eventually emerge as a salient Asian market in the future.

Relegation of Sri Lanka's Geographical Benefits

Sri Lanka is strategically located on the Indian Ocean, a few miles away from the East-West shipping port, where it is estimated that 60,000 ships pass each year, carrying 2/3 of the world's oil and half of all container shipments. The country's SAGT Terminal is one of three terminals in Colombo Port, which handles shipments to India and other subcontinent countries. Transshipments from India account for approximately 75% of its shipments. The other two ports are run by the government and Colombo International Container Terminals.

Sri Lanka's SAGT Port Ranked 4th Globally for Productivity. Source: Lanka Times

China has been spearheading investment in Sri Lanka, which has included highways, ports, and an airport in the south. China also wants to build a controversial $1.4 billion port city in Sri Lanka, and was recently given permission, after delays from this project due to protests. This project is being funded by China Communications Constructions (OTCPK:CCCGF). China has also identified the country as a key point on the maritime Silk Road, which will extend from China to Africa.

This strong attention from China has been balanced with significant FDI from India, which was reluctant after 2009 due to human rights concerns for the Tamil population in Sri Lanka, as India also has a large Tamil population in Tamil Nadu. India seeks to be active in FDI in Sri Lanka, in order to compete with China, and to foster close relations with Sri Lanka, which is already a strong trade partner.

Stock Market

Sri Lanka's stock market has approximately 294 listed companies in 24 business sectors, with a market capitalization of around $18 billion. The appeal of its stock market is for a long-term hold, as performance this year has not been stellar.

•The index has declined by 7.7% in the past year.

•Sri Lanka trades at a strong discount to emerging Asia, with an average P/E of 11.8.

As with many frontier markets, it is simple to construct a portfolio with lower valuation, mainly by avoiding high valuation found in certain sections of the consumer discretionary sector, and identifying areas that have had a boom in earnings growth. A target single-digit P/E is certainly feasible for Sri Lanka.

Improved Inflation

Sri Lanka's inflation most recently fell to 2%, a far cry from the higher levels experienced during 2012-2014.

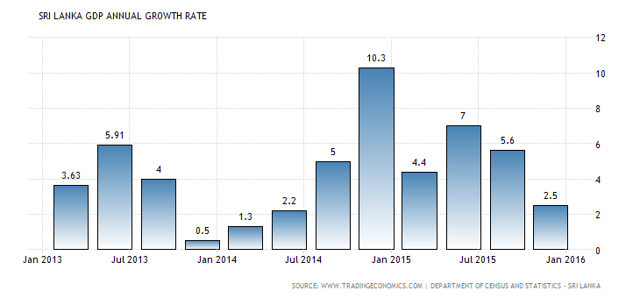

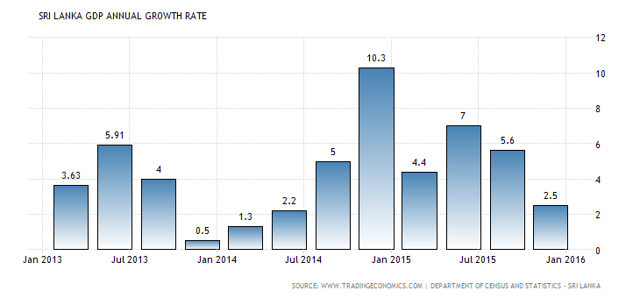

Annual GDP Growth

Sri Lanka's economy is projected to grow by 5.6% annually through 2016-2020, driven strongly by tourism, tea exporting, logistics, IT, and construction. Sri Lanka's economy already has a strong benchmark of growth, as annual GDP growth has averaged at 6.15% since 2003.

Consumer Spending

Consumer spending growth has been strong in Sri Lanka, making the appeal of value investing in this industry very strong. Tea exporting companies and distilleries are two noteworthy areas where valuation is particularly low.

Growth in the Tourism Industry

Sri Lanka's tourism industry has much to offer due to the end of the country's Civil War in 2009, and tourist arrivals increased by 16% during 2015, with a notable 30% increase in tourists from India. Mark Mobius's views on Sri Lanka's tourism industry are very positive.

The entire country is really a tourist haven. It has history, it has beautiful beaches, it has nice people and it's small enough so you can see everything in a week or less.

The end of Sri Lanka's Civil War in 2009 has served as a catalyst for the increased appeal of its tourism industry, and there is still ample room for growth ahead.

Healthcare Industry

Sri Lanka's healthcare industry is an area for strong consideration, driven by the following advantages:

•9% of its population is currently over 65 years old, and this amount is likely to double by 2030, according to a rating by Fitch.

•Private hospitals have achieved 21% CAGR in the past four years, compared to the public sector's growth of 10%.

•70% of the country's population uses private hospitals.

•Health expenditure per capita in Sri Lanka is only $127, significantly lagging behind much of emerging Asia.

This area provides strong opportunity for growth in the future, and several listed private hospitals are available at reasonable valuation.

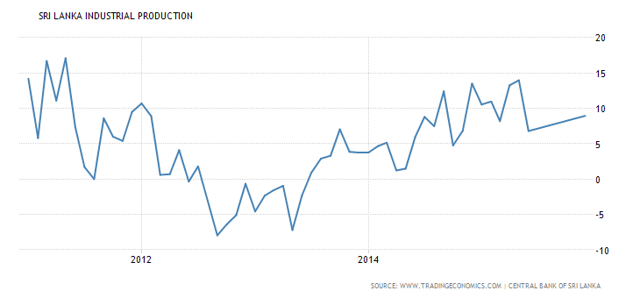

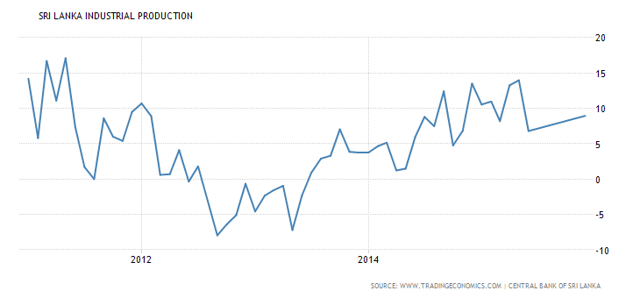

Industrial Production/Manufacturing

Sri Lanka's industrial production has risen substantially, and the country's manufacturing industry presents strong opportunities. Sri Lanka is poised to benefit more if it can join trade agreements, and bring in more FDI, as FDI currently only accounts for 2% of its GDP. Employment in the manufacturing sector is comparatively attractive, as workers can earn substantially more than working in the agriculture sector. One particularly strong, high growth area is for tile manufacturers, as several stocks in this area have surged in earnings growth, and trade at very low valuation.

Banking Industry

The opportunity in Sri Lanka's banking industry is also worth noting, as several listed banks traded at a strong discount to the CSE Index. NPLs historically averaged near 4.5% since 2010, and declined to 4.2% as of September 2015. The main threats for the increase of NPLs in the future include slowed economic growth, rising interest rates, and banks having exposure to SOEs in their assets. In addition to low valuation, some banks in Sri Lanka can also be positively noted for high CAR, ROE, and profit margins.Sri Lanka is also a strong outlier in frontier Asia in terms of its high banked population, as around 83% of its population is already banked, yet other Asian frontier markets such as Bangladesh, Vietnam, and Pakistan can offer more in terms of growth due to their comparatively lower banked population.

Areas of Concern

Overall, we can clearly see strong trends of economic growth, low valuation and a consequent strong appeal for Sri Lanka's stock market, as well as improvement of previous political and economic risks. The following areas of risk should be noted, although fundamentals are certainly strong enough to create a strong case for value investing.

•Low Liquidity: A common challenge for any frontier market.

•Debt: Sri Lanka's government debt to GDP is 75.5%, notably higher than its frontier Asian peers. Sri Lanka requested a $1.5 billion loan from the IMF, and is also planning to sell $3 billion worth of bonds in global markets this year. The yield for Sri Lanka's bonds has soared to 11.6%!

•Corporate Tax Rate: Sri Lanka's corporate tax rate is 28%, well above other attractive destinations such as Vietnam, which offer further incentives beyond the existing low 20% corporate tax rate.

•SOEs: SOEs, which account for 18% of the country's GDP, have been criticized for poor financial performance.

•Trade Deficit: Sri Lanka's trade deficit has averaged at -$457 million since 2003. The country's main exports are textiles and tea, which both account for approximately 57% of its exports.

Conviction

Sri Lanka has witnessed strong recovery on the political front, and its strategic geographical location and strong trends of growth both make it a strong futuristic investment destination in Asia. There is unfortunately no ETF for Sri Lanka, despite other Asian frontier markets such as Vietnam and Pakistan having ETFs. The iShares MSCI Frontier 100 Index ETF (NYSEARCA:FM) only invests around 2.1% of it assets in Sri Lanka, and Sri Lanka's stock market performance has been substantially better, as this ETF has declined by 16.8% in the past year.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Source: http://seekingalpha.com/article/3970044-sri-lanka-intriguing-areas-consider-value-investing

Summary

* Sri Lanka is geographically poised to benefit due to its strategic location on the Indian Ocean, where it operates multiple ports. Its SAGT port ranked 4th globally for productivity.

* Specific opportunities can be found in these areas: Tea exporting, tourism, distilleries, healthcare, banking, and select areas of manufacturing.

* Sri Lanka's Civil War ended in 2009, and the country's improved political landscape has been a catalyst for improved economics.

Opportunity Overview

The stock market discount and comparatively stronger trends of growth present in frontier Asia is intriguing, and a buy frontier, sell emerging approach is one of the most clear cut ways to prosper when investing in Asia. These trends, coupled with noteworthy political improvements, can be combined to create a strong value investing case. Sri Lanka is a strong frontier market in Asia that meets all of these requirements, yet is being relegated by many foreign investors. Sri Lanka has been benefiting from the end of the country's 26-year civil war that ended in 2009, which has produced a much more favourable political landscape. This improvement has been coupled with Sri Lanka's new government, which was elected in January 2015. On top of this, the country has been experiencing rapid growth in consumption, and has some interesting investment opportunities found in areas such as banking, healthcare, tea exporting companies, construction, manufacturing, logistics, and consumer goods. The country of 21 million has comparatively lower wages, and a literacy rate of 92%, the highest in South Asia, and among the highest in Asia. However, the most salient, and overlooked opportunity, is the country's strategic geographical placement on the Indian Ocean, allowing it to be strong economic centre for logistics. This strategic benefit will be modestly complemented by other strong trends, and allow Sri Lanka to eventually emerge as a salient Asian market in the future.

Relegation of Sri Lanka's Geographical Benefits

Sri Lanka is strategically located on the Indian Ocean, a few miles away from the East-West shipping port, where it is estimated that 60,000 ships pass each year, carrying 2/3 of the world's oil and half of all container shipments. The country's SAGT Terminal is one of three terminals in Colombo Port, which handles shipments to India and other subcontinent countries. Transshipments from India account for approximately 75% of its shipments. The other two ports are run by the government and Colombo International Container Terminals.

Sri Lanka's SAGT Port Ranked 4th Globally for Productivity. Source: Lanka Times

China has been spearheading investment in Sri Lanka, which has included highways, ports, and an airport in the south. China also wants to build a controversial $1.4 billion port city in Sri Lanka, and was recently given permission, after delays from this project due to protests. This project is being funded by China Communications Constructions (OTCPK:CCCGF). China has also identified the country as a key point on the maritime Silk Road, which will extend from China to Africa.

This strong attention from China has been balanced with significant FDI from India, which was reluctant after 2009 due to human rights concerns for the Tamil population in Sri Lanka, as India also has a large Tamil population in Tamil Nadu. India seeks to be active in FDI in Sri Lanka, in order to compete with China, and to foster close relations with Sri Lanka, which is already a strong trade partner.

Stock Market

Sri Lanka's stock market has approximately 294 listed companies in 24 business sectors, with a market capitalization of around $18 billion. The appeal of its stock market is for a long-term hold, as performance this year has not been stellar.

•The index has declined by 7.7% in the past year.

•Sri Lanka trades at a strong discount to emerging Asia, with an average P/E of 11.8.

As with many frontier markets, it is simple to construct a portfolio with lower valuation, mainly by avoiding high valuation found in certain sections of the consumer discretionary sector, and identifying areas that have had a boom in earnings growth. A target single-digit P/E is certainly feasible for Sri Lanka.

Improved Inflation

Sri Lanka's inflation most recently fell to 2%, a far cry from the higher levels experienced during 2012-2014.

Annual GDP Growth

Sri Lanka's economy is projected to grow by 5.6% annually through 2016-2020, driven strongly by tourism, tea exporting, logistics, IT, and construction. Sri Lanka's economy already has a strong benchmark of growth, as annual GDP growth has averaged at 6.15% since 2003.

Consumer Spending

Consumer spending growth has been strong in Sri Lanka, making the appeal of value investing in this industry very strong. Tea exporting companies and distilleries are two noteworthy areas where valuation is particularly low.

Growth in the Tourism Industry

Sri Lanka's tourism industry has much to offer due to the end of the country's Civil War in 2009, and tourist arrivals increased by 16% during 2015, with a notable 30% increase in tourists from India. Mark Mobius's views on Sri Lanka's tourism industry are very positive.

The entire country is really a tourist haven. It has history, it has beautiful beaches, it has nice people and it's small enough so you can see everything in a week or less.

The end of Sri Lanka's Civil War in 2009 has served as a catalyst for the increased appeal of its tourism industry, and there is still ample room for growth ahead.

Healthcare Industry

Sri Lanka's healthcare industry is an area for strong consideration, driven by the following advantages:

•9% of its population is currently over 65 years old, and this amount is likely to double by 2030, according to a rating by Fitch.

•Private hospitals have achieved 21% CAGR in the past four years, compared to the public sector's growth of 10%.

•70% of the country's population uses private hospitals.

•Health expenditure per capita in Sri Lanka is only $127, significantly lagging behind much of emerging Asia.

This area provides strong opportunity for growth in the future, and several listed private hospitals are available at reasonable valuation.

Industrial Production/Manufacturing

Sri Lanka's industrial production has risen substantially, and the country's manufacturing industry presents strong opportunities. Sri Lanka is poised to benefit more if it can join trade agreements, and bring in more FDI, as FDI currently only accounts for 2% of its GDP. Employment in the manufacturing sector is comparatively attractive, as workers can earn substantially more than working in the agriculture sector. One particularly strong, high growth area is for tile manufacturers, as several stocks in this area have surged in earnings growth, and trade at very low valuation.

Banking Industry

The opportunity in Sri Lanka's banking industry is also worth noting, as several listed banks traded at a strong discount to the CSE Index. NPLs historically averaged near 4.5% since 2010, and declined to 4.2% as of September 2015. The main threats for the increase of NPLs in the future include slowed economic growth, rising interest rates, and banks having exposure to SOEs in their assets. In addition to low valuation, some banks in Sri Lanka can also be positively noted for high CAR, ROE, and profit margins.Sri Lanka is also a strong outlier in frontier Asia in terms of its high banked population, as around 83% of its population is already banked, yet other Asian frontier markets such as Bangladesh, Vietnam, and Pakistan can offer more in terms of growth due to their comparatively lower banked population.

Areas of Concern

Overall, we can clearly see strong trends of economic growth, low valuation and a consequent strong appeal for Sri Lanka's stock market, as well as improvement of previous political and economic risks. The following areas of risk should be noted, although fundamentals are certainly strong enough to create a strong case for value investing.

•Low Liquidity: A common challenge for any frontier market.

•Debt: Sri Lanka's government debt to GDP is 75.5%, notably higher than its frontier Asian peers. Sri Lanka requested a $1.5 billion loan from the IMF, and is also planning to sell $3 billion worth of bonds in global markets this year. The yield for Sri Lanka's bonds has soared to 11.6%!

•Corporate Tax Rate: Sri Lanka's corporate tax rate is 28%, well above other attractive destinations such as Vietnam, which offer further incentives beyond the existing low 20% corporate tax rate.

•SOEs: SOEs, which account for 18% of the country's GDP, have been criticized for poor financial performance.

•Trade Deficit: Sri Lanka's trade deficit has averaged at -$457 million since 2003. The country's main exports are textiles and tea, which both account for approximately 57% of its exports.

Conviction

Sri Lanka has witnessed strong recovery on the political front, and its strategic geographical location and strong trends of growth both make it a strong futuristic investment destination in Asia. There is unfortunately no ETF for Sri Lanka, despite other Asian frontier markets such as Vietnam and Pakistan having ETFs. The iShares MSCI Frontier 100 Index ETF (NYSEARCA:FM) only invests around 2.1% of it assets in Sri Lanka, and Sri Lanka's stock market performance has been substantially better, as this ETF has declined by 16.8% in the past year.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Source: http://seekingalpha.com/article/3970044-sri-lanka-intriguing-areas-consider-value-investing

Subscribe to:

Comments (Atom)