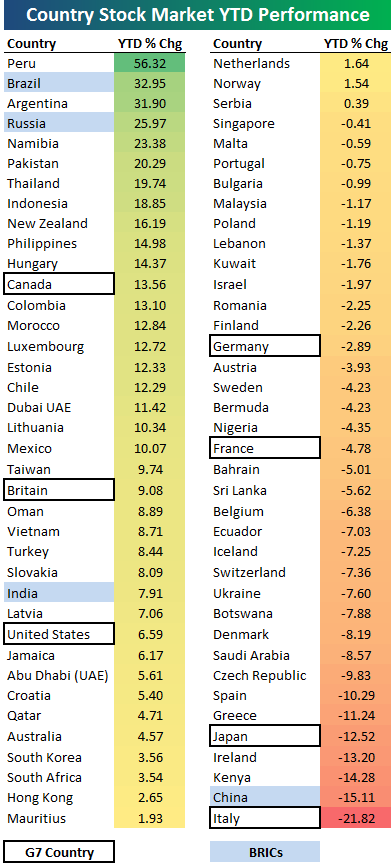

Below is a list highlighting the year-to-date percentage change (in local currency) for the main stock market indices of 76 countries around the world. Overall, 41 of 76 countries (54%) are in positive territory for the year, while the average country is now up 3.7% YTD. Peru’s stock market is currently at the top of the list with a 2016 gain of 56.32%. Brazil ranks 2nd at +32.95%, followed by Argentina (+31.90%) and Russia (+25.97%). Namibia rounds out the top five with a YTD gain of 23.38%.

Of the G7 countries, Canada is on top with a gain of 13.56%. The UK (yes, the UK) ranks second with a YTD gain of 9.08%, but remember, this is in local currency, so it doesn’t factor in the 12% drop that the pound has seen this year. Priced in dollars, the UK’s stock market is down roughly 3.5% year to date. Even that doesn’t seem too bad, though, given the Brexit freak-out that occurred at the end of June.

The US is the only other G7 country in the black this year with a gain of 6.59%. Germany, France, Japan and Italy are all in the red, with Italy actually ranking dead last out of all countries at -21.82%. China ranks second to last with a decline of 15.11%, but the other three BRIC countries are solidly in the black.

Source: www.bespokepremium.com

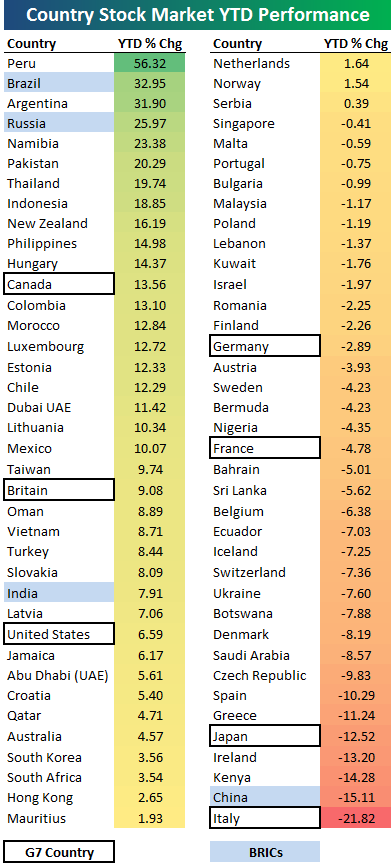

Of the G7 countries, Canada is on top with a gain of 13.56%. The UK (yes, the UK) ranks second with a YTD gain of 9.08%, but remember, this is in local currency, so it doesn’t factor in the 12% drop that the pound has seen this year. Priced in dollars, the UK’s stock market is down roughly 3.5% year to date. Even that doesn’t seem too bad, though, given the Brexit freak-out that occurred at the end of June.

The US is the only other G7 country in the black this year with a gain of 6.59%. Germany, France, Japan and Italy are all in the red, with Italy actually ranking dead last out of all countries at -21.82%. China ranks second to last with a decline of 15.11%, but the other three BRIC countries are solidly in the black.

Source: www.bespokepremium.com