"There can be no progress nor achievement without sacrifice, and a man's worldly success will be by the measure that he sacrifices his confused animal thoughts, and fixes his mind on the development of his plans, and the strengthening of his resolution and self-reliance." - James Allen

Here at Srilanka Share Market, we’re on a mission to provide first hand information to those who are willing to invest or trade in Colombo Stock Exchange. Also heading into share market could be scary, but we SriLanka Share Market turn that fear into fun by providing educational, research materials from respectable sources.

Sunday, 31 December 2017

Saturday, 30 December 2017

Templeton’s 22 Principles For Successful Investing

- There is only one long term investment objective, maximum total after tax return.

- Success requires study and work. It’s harder than you think.

- Outperforming the majority of investors requires doing what they are not doing.

- Buy when pessimism is at its maximum, sell when optimism is at its maximum.

- Therefore, buy what most investors are selling.

- Buying when others have despaired, and selling when they are full of hope, takes fortitude.

- Bear markets aren’t forever. Prices usually turn up a year before the business cycle hits bottom.

- Popularity is temporary. When a sector goes out of fashion, it stays out for many years.

- In the long run, stock index prices fluctuate around the EPS trend line.

- Stock index earnings fluctuate around replacement book value for the stocks in the index.

- Buy what other people buy and you will succeed or fail as other people do.

- Timing: buy when short term owners have finished selling and sell when they’ve finished their buying, always opposing the fashion.

- Stock prices fluctuate more than values. So stock indexes will never produce the best total return performance.

- Focus on value because most investors focus on outlooks and trends.

- Invest worldwide.

- Stock price fluctuations are proportional to the square root of the price.

- Sell when you find a much better bargain to replace what you are selling.

- When your method becomes popular, switch to an unpopular method.

- Stay flexible. No asset or method is forever.

- Stock market investing takes more skill than any other kind of investing.

- A person can outperform a committee.

- If you begin with prayer, you will think more clearly and make fewer mistakes.

Friday, 29 December 2017

Quote for the day

"Many people lose the small joys in the hope for the big happiness." - Pearl S. Buck

Thursday, 28 December 2017

Quote for the day

"What keeps so many people back is simply unwillingness to pay the price, to make the exertion, the effort to sacrifice their ease and comfort." - Orison Swett Marden

Wednesday, 27 December 2017

Quote for the day

"By the way that we think and by the way that we believe in things, in that way our world is created." - Pema Chodron

Tuesday, 26 December 2017

Quote for the day

"To make no mistakes is not in the power of man; but from their errors and mistakes the wise and good learn wisdom for the future." - Plutarch

Monday, 25 December 2017

10 Lessons for Traders

10) Those who are willing can be taught almost anything.

9) Great people want to help others achieve great success.

8) Success in business requires tremendous concentration. Outside distractions must be avoided.

7) Sometimes it is best to leave politics to politicians.

6) Everyone fails at some point in his life. The true winners rebuild after their failures.

5) To put on a trade when everything is going against you requires character and commitment.

4) Rules are rules. Stick to them.

3) Adapt with the times. Be willing to be malleable.

2) Always leave yourself outs. Never commit everything to one position or to one person.

And the number one lesson:

1) The market is bigger, stronger and badder than you. Always respect it for the beast it is.

9) Great people want to help others achieve great success.

8) Success in business requires tremendous concentration. Outside distractions must be avoided.

7) Sometimes it is best to leave politics to politicians.

6) Everyone fails at some point in his life. The true winners rebuild after their failures.

5) To put on a trade when everything is going against you requires character and commitment.

4) Rules are rules. Stick to them.

3) Adapt with the times. Be willing to be malleable.

2) Always leave yourself outs. Never commit everything to one position or to one person.

And the number one lesson:

1) The market is bigger, stronger and badder than you. Always respect it for the beast it is.

Source: www.dailyspeculations.com

Quote for the day

"A life is made up of a great number of small incidents, and a small number of great ones." - Roald Dahl

Sunday, 24 December 2017

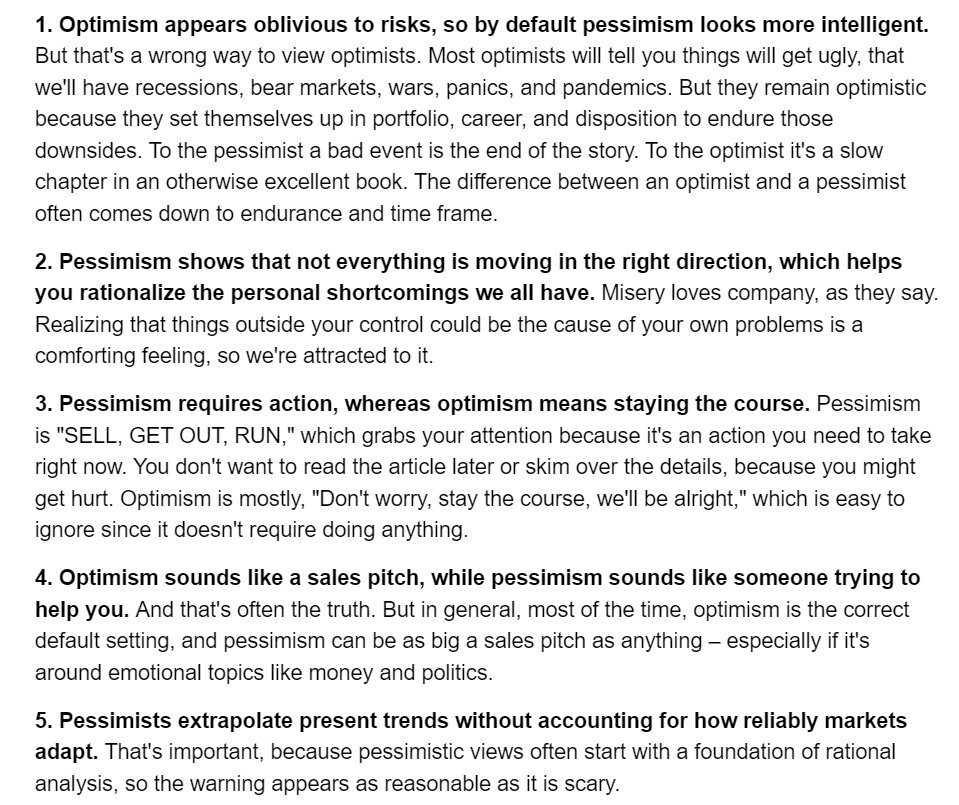

Optimism vs. Pessimism in Markets

Quote for the day

"Without enthusiasm you are doomed to a life of mediocrity, but with it you can accomplish miracles." - Og Mandino

Saturday, 23 December 2017

Quote for the day

"We never get upset over what happens. Never. We get upset because of preconceived ideas as to what we think should happen, what we want to happen. When our preference clashes with the reality, we get hurt. Rid yourself of all preconceived ideas as to what should happen. You are then at peace whatever happens." - Vernon Howard

Friday, 22 December 2017

Thursday, 21 December 2017

Quote for the day

"Faith sees the invisible, believes the unbelievable, and receives the impossible." - Corrie ten Boom

Wednesday, 20 December 2017

Tuesday, 19 December 2017

Quote for the day

"The best thing to give to your enemy is forgiveness; to an opponent, tolerance; to a friend, your heart; to your child, a good example; to a father, deference; to your mother, conduct that will make her proud of you; to yourself, respect; to all others, charity." - Benjamin Franklin

Monday, 18 December 2017

Quote for the day

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.” - Warren Buffett

Sunday, 17 December 2017

Quote for the day

"Much of what we called "depression" was really dissatisfaction, a result of setting a bar impossibly high or expecting treasures we weren't willing to work for." - Mitch Albom

Saturday, 16 December 2017

The 12 Unbreakable Rules for Succeeding as a Trader

By Darrin Donnelly

The dream of being a successful trader, especially someone who trades for a living, is one of those “big” dreams that naysayers love to squash. Don’t listen to these cynics. There are too many examples of people who have started with very little and made fortunes trading. You can be certain they’re glad they didn’t listen to the naysayers. On the other side of the coin, make sure that you really enjoy trading before committing to it. All the great traders I know have a true PASSION for the game of trading. If you don’t have a passion for trading, you won’t last long.

Rule No. 2: Put Your Time and Energy into the Things You Can Control and Don’t Worry about the Things You Can’t Control

You must realize that you can’t control what the market, or a particular stock, does. All you can do is control your reaction to what it does. Focus all your effort on making good decisions based on what actually happens and don’t worry about trying to GUESS what happens next or beat yourself up over things that happened in the past.

Rule No. 3: Find the Trading System that Fits YOU Best

Guys like Warren Buffett make millions with value investing, guys like Nicolas Darvas made millions trend trading, and some guys make a living day trading. There is no “Holy Grail” trading strategy that magically spits out money. There are several different trading systems that “work” and each of these strategies will outperform others at certain times. You need to find the system that fits your personality best and stick with it. The new trader will go broke constantly changing their strategies and chasing different systems.

Rule No. 4: Protect the Money You Have with Proper Risk Management

Defense wins championships, in sports and in trading. That means protecting the downside first. I’m all for positive thinking, but to succeed as a trader you must always plan for the worst. You should never enter a trade without knowing exactly where you will exit it if it goes against you.

Rule No. 5: Give Yourself an Unfair Advantage

To succeed as a trader, you need to stack the odds in your favor and the only way to do this is to cut your losses quick and let your winners run. Successful trend traders can make a fortune hitting well below 50% winners. They do this by making sure that, over the long term, the profits on their winners are much larger than the losses on their losers. It’s such a simple strategy, but so many new traders fail to understand it.

Rule No. 6: Follow Your System’s Rules

Never trade on hunches, guesses, predictions, or emotions. Once you decide on the system that’s right for you, you need to follow its rules. Is there ever a time for discretion? Sure, but I like to say that discretionary decisions should be limited to 10-15% of your trades. If you’re making “exceptions” to your system’s rules more often than that, you’re heading down a destructive path.

Rule No. 7: Keep It Simple

I’ve found that the best trading systems are simple. It’s easy to understand why they work and it’s easy to follow their rules. The more complicated a system is, the more room for error there is. That’s probably why I’m such a fan of the Darvas Trading System, which remains a very simple trend following strategy.

Rule No. 8: Trade Less, Not More

I see a lot of new traders who think they have to be in the market at all times. They also tend to think that every trade decision needs to be all-in or all-out. The truth is, there are times when the right trade is no trade at all and you have to wait for the market to show you where it’s heading. Trying to be all-in, all the time will lead to whipsaws that whittle away at your portfolio.

Rule No. 9: Focus on Fewer Stocks

Due to popular images of the trading world’s go-go culture, many people think that being a successful trader means frantically chasing hundreds of stocks. The truth is, most of history’s great traders – legends like Jesse Livermore, Gerald Loeb, and Nicolas Darvas – spoke often about the danger of trading too many stocks. For Darvas System traders, we focus on the 4-8 true market leaders. The big money is made in those elite leaders, so there’s no reason to be trading dozens of lesser-quality stocks.

Rule No. 10: See the BIG Picture and Follow the Larger Trend

For trend traders, it’s important to focus on the big trends in the market and in individual stocks. Getting too caught up in the intraday action can cause you to make poor, emotional decisions. Often times, the best traders only need to check the market once or twice a day. Some check it even less. When you find yourself getting rattled by the day-to-day market noise, switch to weekly charts or step away from the market altogether for a day or two. A big picture perspective is essential.

Rule No. 11: NEVER Stop Learning

The moment you think you’ve got it all figured out is the moment you’ve likely topped out. Great traders never stop learning, researching, and getting help from other traders. Though the general trading strategies that have been proven to work for decades will continue to work, the details are changing often and need to be adapted to. Be humble and don’t ever stop learning.

Rule No. 12: Don’t EVER Quit

You have to have patience, discipline, and perseverance to succeed at this game. Every trader will hit losing streaks and frustrating times. It’s during these times when the urge to quit or change strategies is at its highest. Don’t do it. If it was easy, everyone would be making millions trading. It requires hard work and mental toughness to be a successful trader and there will be times when you have to swallow your pride, buck up, and persevere even when you don’t feel like it. But remember, as Mike Ditka said, “You’re never a loser until you quit trying.”

I like to keep things simple. As Albert Einstein said, “Everything should be made as simple as possible . . . but not simpler.”

With that in mind, here is a list of 12 simple rules that I have found to be the key to successful trading. If you’re not getting the results you want as a trader, you’re breaking one or more of these rules.

Rule No. 1: Follow YOUR Dreams

With that in mind, here is a list of 12 simple rules that I have found to be the key to successful trading. If you’re not getting the results you want as a trader, you’re breaking one or more of these rules.

Rule No. 1: Follow YOUR Dreams

The dream of being a successful trader, especially someone who trades for a living, is one of those “big” dreams that naysayers love to squash. Don’t listen to these cynics. There are too many examples of people who have started with very little and made fortunes trading. You can be certain they’re glad they didn’t listen to the naysayers. On the other side of the coin, make sure that you really enjoy trading before committing to it. All the great traders I know have a true PASSION for the game of trading. If you don’t have a passion for trading, you won’t last long.

Rule No. 2: Put Your Time and Energy into the Things You Can Control and Don’t Worry about the Things You Can’t Control

You must realize that you can’t control what the market, or a particular stock, does. All you can do is control your reaction to what it does. Focus all your effort on making good decisions based on what actually happens and don’t worry about trying to GUESS what happens next or beat yourself up over things that happened in the past.

Rule No. 3: Find the Trading System that Fits YOU Best

Guys like Warren Buffett make millions with value investing, guys like Nicolas Darvas made millions trend trading, and some guys make a living day trading. There is no “Holy Grail” trading strategy that magically spits out money. There are several different trading systems that “work” and each of these strategies will outperform others at certain times. You need to find the system that fits your personality best and stick with it. The new trader will go broke constantly changing their strategies and chasing different systems.

Rule No. 4: Protect the Money You Have with Proper Risk Management

Defense wins championships, in sports and in trading. That means protecting the downside first. I’m all for positive thinking, but to succeed as a trader you must always plan for the worst. You should never enter a trade without knowing exactly where you will exit it if it goes against you.

Rule No. 5: Give Yourself an Unfair Advantage

To succeed as a trader, you need to stack the odds in your favor and the only way to do this is to cut your losses quick and let your winners run. Successful trend traders can make a fortune hitting well below 50% winners. They do this by making sure that, over the long term, the profits on their winners are much larger than the losses on their losers. It’s such a simple strategy, but so many new traders fail to understand it.

Rule No. 6: Follow Your System’s Rules

Never trade on hunches, guesses, predictions, or emotions. Once you decide on the system that’s right for you, you need to follow its rules. Is there ever a time for discretion? Sure, but I like to say that discretionary decisions should be limited to 10-15% of your trades. If you’re making “exceptions” to your system’s rules more often than that, you’re heading down a destructive path.

Rule No. 7: Keep It Simple

I’ve found that the best trading systems are simple. It’s easy to understand why they work and it’s easy to follow their rules. The more complicated a system is, the more room for error there is. That’s probably why I’m such a fan of the Darvas Trading System, which remains a very simple trend following strategy.

Rule No. 8: Trade Less, Not More

I see a lot of new traders who think they have to be in the market at all times. They also tend to think that every trade decision needs to be all-in or all-out. The truth is, there are times when the right trade is no trade at all and you have to wait for the market to show you where it’s heading. Trying to be all-in, all the time will lead to whipsaws that whittle away at your portfolio.

Rule No. 9: Focus on Fewer Stocks

Due to popular images of the trading world’s go-go culture, many people think that being a successful trader means frantically chasing hundreds of stocks. The truth is, most of history’s great traders – legends like Jesse Livermore, Gerald Loeb, and Nicolas Darvas – spoke often about the danger of trading too many stocks. For Darvas System traders, we focus on the 4-8 true market leaders. The big money is made in those elite leaders, so there’s no reason to be trading dozens of lesser-quality stocks.

Rule No. 10: See the BIG Picture and Follow the Larger Trend

For trend traders, it’s important to focus on the big trends in the market and in individual stocks. Getting too caught up in the intraday action can cause you to make poor, emotional decisions. Often times, the best traders only need to check the market once or twice a day. Some check it even less. When you find yourself getting rattled by the day-to-day market noise, switch to weekly charts or step away from the market altogether for a day or two. A big picture perspective is essential.

Rule No. 11: NEVER Stop Learning

The moment you think you’ve got it all figured out is the moment you’ve likely topped out. Great traders never stop learning, researching, and getting help from other traders. Though the general trading strategies that have been proven to work for decades will continue to work, the details are changing often and need to be adapted to. Be humble and don’t ever stop learning.

Rule No. 12: Don’t EVER Quit

You have to have patience, discipline, and perseverance to succeed at this game. Every trader will hit losing streaks and frustrating times. It’s during these times when the urge to quit or change strategies is at its highest. Don’t do it. If it was easy, everyone would be making millions trading. It requires hard work and mental toughness to be a successful trader and there will be times when you have to swallow your pride, buck up, and persevere even when you don’t feel like it. But remember, as Mike Ditka said, “You’re never a loser until you quit trying.”

http://www.darvastrader.com

Quote for the day

"A mediocre person tells. A good person explains. A superior person demonstrates. A great person inspires others to see for themselves." - Harvey Mackay

Friday, 15 December 2017

Quote for the day

"Normally, I try not to pay attention to my haters, but this time I'd like to talk about it, because my haters are my motivators." - Ellen DeGeneres

Thursday, 14 December 2017

Quote for the day

"The fact that so many successful politicians are such shameless liars is not only a reflection on them, it is also a reflection on us. When the people want the impossible, only liars can satisfy." - Thomas Sowell

Wednesday, 13 December 2017

Quote for the day

"When work is a pleasure, life is a joy! When work is a duty, life is slavery." - Maxim Gorky

Tuesday, 12 December 2017

Investments in listed securities and best practices to follow; practical guidance from a compliance

Investment in financial instruments has never been easier than today. With the sphere of new technology, an investor is able to invest not only in his or her own jurisdiction but also in other countries’ financial markets. The capital market is an attractive investment arena for many long-term and short-term investors regardless of the risk involved in listed securities. This is no different to the Sri Lankan context where investors invest through the Colombo Stock Exchange (CSE), the only stock exchange in the country. The capital market in Sri Lanka is regulated by the Securities & Exchange Commission of Sri Lanka (SEC) and its participants and activities are also subject to the rules of the CSE.

The CSE has its own rules applicable to the stockbroking companies (member firms). The nature of the many disputes between the investors and the member firms show that the investors tend to believe that the whole responsibility of their investment lies on the member firms through which they invest in and the responsibility for the financial soundness of the member firms lies with the SEC.

However, the investors have not only the rights but also the responsibilities in investing. The informed investors who are aware of their rights and responsibilities in investing are better able to prevent disputes with their broker firms and also reduce the risk of losing their investment portfolio due to fraudulent activities that can occur in the securities industry.

The following are some of the best practices that every investor needs to adhere to when investing in listed securities.

1. Understand that all investment involve risk and securities investment is no exception; rather securities investment is one of the more riskier categories of investments

Every investment carries some degree of risk and greater the potential for high returns (or earning) of an investment, the greater the risks as well. If you deposit your money in a licensed bank or a financial institution, depending on the tenure you still have to take the interest rate risk and inflation risk, however, the chance of you losing your capital is remote. When it comes to the securities investments, this completely changes; you may invest in listed stocks, debentures and unit trust funds. These investments involve varying degree of risks. For example, one of the main risks is market risk; that is the capital can erode in value if the price falls down and if you are forced to sell for less than what you purchased for. For example, Rule 7.1.3 of the CSE Stockbroker Rules requires that in the event the market value of the securities pledged by you falls by 25%, the member firm should inform you to meet the shortfall by the next market day. As per Rule 7.1.4, in the event you fail to meet the shortfall on the next market day, the member firm should immediately sell the securities which have been pledged by you, in order to ensure compliance with Rule 7.1.3. Such force selling along with the market risk factor can contribute to huge losses in your account.

This can happen very often and in any market due to numerous reasons. Likewise liquidity risk, political risk etc., are some of the other risks. Therefore, knowing that all investments involve risks and understanding whether you are willing to take some risk is one of the best practices in investing responsibly. Most of the capital market broker-client disputes that happen in the Sri Lankan context are due to the investors’ lack of understanding of the risks involved in their investments or the outcome of such risks. Some of the broker firms also do not encourage detailed discussions about the risk factors thinking that such discussions would scare the investor away. However, the CSE Stockbroker Rules requires all the brokers to include a risk disclosure statement to their client agreement/ account opening form. The minimum risk disclosure that is required to be included in the agreement is “the prices of securities fluctuate, sometimes drastically. The price of a security may move up or down, and may even become valueless. It is likely that losses may be incurred rather than profits made as a result of buying and selling securities”. Many investors may have seen the risk disclosure, however pay very little attention to that. If you want to understand the risks in your investments, you should carefully read and understand these risk disclosures, request your investment advisors to explain where it is not clear to you and ask questions and take independent advice if seems necessary.

2. Know your broker (KYB) firm and your investment advisor before opening an account

The broker firms play the role of a market intermediary and are regulated and licensed by the SEC. Information about the brokers licensed by the SEC including the names of broker firms, their contact details, website links and the CEO’s name and all the brokers licensed by the SEC is given on the CSE website. Ask about the broker firm’s client compliant history and whether there are outstanding court judgments etc. Doing some research about the broker firm and its investment advisors before you invest any money with them can certainly help you avoid problems as well as certain financial losses.

Investment advisors of the broker firm who are licensed by the SEC are permitted to deal with the clients on behalf of the broker firms. It is a requirement of the SEC that only the licensed investment advisors can deal with the broker firm’s clients and the trainees should be under the supervision of a senior licensed advisor. When an investor is looking for an investment advisor to work with, it is always good to request the broker firm the opportunity to meet with several investment advisors face to face to compare them before making any decision. Ask about the work experience of the Investment Advisor, any disciplinary actions against the investment advisor by the broker firm or the SEC or CSE. Generally the broker firms allocate investment advisors to their new clients based on their availability, portfolio size, clients investment objectives, communication needs etc. One of the negative practices in the industry is that many clients do not meet their investment advisor and only communicate with the investment advisor over the telephone or through emails and do not even see their investment advisor until a dispute happens. The investors have the right to decide on the investment advisor that they like to work with(subject to the availability of such investment advisor) and therefore, you should always know your broker firm and the investment advisor in the same manner in which member firms get to know your information through know Your Clients (KYC) practices.

3. Know your investment goals and communicate them to your investment advisor clearly

One of the most important requirements for an investor is to have a clear sense of his investment goals and the timelines attached to those goals. Whilst everyone wants to earn a better return, many investors want to achieve specific financial goals such as owning a house, sending children to foreign universities, or having a comfortable retirement plan. Generally, your investment advisor should ask you for these information in order to understand your profile including your risk appetite and your investment goals before they advise you on your investments. In many countries, the investment managers and investment advisors provide a detailed questionnaire to their clients to collect these information in addition to the information collected through discussions and meetings. For example; Client Assessment Form is a basic document which asks questions on investment goals, investment experience etc. The investor needs to provide accurate information in these forms and communicate their investment objectives and their risk tolerance levels clearly to their investment advisor. It is also important to update the investment advisor when there is a material change to the status of the investor. It is always good to ask for a copy of these forms, so that you know when to update the investment advisor.

4. Learn about your account, its features and related legal documents

What we have seen in the Sri Lankan capital market industry is that many investors do not like documentation part of the relationship. Very often they compare the brokers who request for less documents and tend to open account with such brokers. However, investors need to understand that knowing the nature of the account, features of it, the authority given to the broker and also the clauses of the related documents are similarly important in investing. More often clients misunderstand or do not know what they sign for. Reading the account opening form and learning of the features of your account is extremely important so that you know how to deal with your investment advisor and also the rights and responsibilities of you and your broker.

You need to know who has the authority to make investment decisions. You can have a discretionary or non-discretionary account. If you have a non-discretionary account, that means you have the full authority to make investment decisions with regard to your account. This also means that you are responsible for the decisions you make relating to your portfolio. As per the CSE Rules, the investment advisor should receive order instructions from you to carry out any transaction in your account. The broker firm should send to you a note confirming the purchase or sale of securities by the end of the trade day. Bought/sold note can also be received in electronic form if you have given your consent to the broker for such purposes. It is your responsibility to review those confirmation notes to see whether those transactions have been carried out in accordance with your instructions and to inform the Compliance Officer of the broker firm of any disagreements immediately.

If you have a discretionary account that means your investment advisor has the authority to effect transactions without your specific instructions or without consulting you in advance about the price, type, quantity or timing of each trade as long as trades are consistent with your stated investment objectives. Therefore it is important that you clearly state your investment objectives in your authorisation. The CSE Rules require that the broker firm receives prior written authorisation from the client to effect transactions without the client’s specific instructions.

As mentioned above, it is important to understand the features of a CDS account and how the CSE rules work. In particular, credit limits, conditions attached to extended credits, interest rates, and internet trading facility are some of the notable features you need to be aware of.

On the other hand, you need to know the effect of legal documents that you sign such as credit agreement, account opening form and online trading agreements etc. These are legally binding contracts that govern the terms and conditions of your account and your investments and will be the focus in any future disputes.

5. Learn about the fees and other cost charged to your account

It is important to know all the fees and expenses that you pay with regard to investments. In Sri Lanka the broker firms do not have much authority in this regard and the fee structure is mainly decided by the SEC other than the brokerage for debt instruments and over 100 million equity transactions which are negotiable among the parties subject to a minimum. With effect from 27 June 2017 the cost applicable for equity transactions up to 100 million is 1.12% and for the transactions cost for transactions over 100 million is applied on a step by step basis. As per the CSE Rules, if you fail to make payment for securities you purchase by 9.00 hours on the settlement date, which is T+3, your broker firm can at its absolute discretion recover interest commencing from the day after the settlement date up to the date of final settlement. This is however subject to maximum of 0.1% per day. In order to avoid surprises such as huge interest charged to your account, it is always better to understand the charges and take necessary action before it’s too late. Remember, Over T+3 credit almost always comes with a cost attached to it.

6. Keep records, monitor your account and if there is a problem with your account report immediately in writing

The broker firms are required to maintain proper records of all their clients and investments, however, it is important that you maintain your own copy of your investment related documents such as a copy of the account opening form, credit agreement, letters granting discretionary authority to your investment advisor, trade confirmations and other important correspondence with the broker firm. As you make investments and trade in your account, you should receive trade confirmation for each trade which should include the transaction details required by the CSE Rules. If you are a debtor, you should also receive your monthly account statement by the 7th day of the following month. Reviewing all your transactions promptly enable you to monitor your account for any unauthorised activity. It is also important to know that the investment advisors should act in the best interest of the clients and they are prohibited from trading excessively in their clients’ accounts. If you notice any unauthorised transaction, excessive trading or an error in your account, you need to inform the Compliance Officer of your broker firm immediately and the communication should be in writing. This will help you to minimise the possible financial losses to your account and also to settle disputes if any in a timely manner. The CSE Rules require any complaint first be referred to the Compliance Officer of the broker firm, in writing, within a period of three months from the date of transactions and this time restriction is only waived by the CSE under exceptional circumstances.

7. Understand your investments and ask questions

Investment advisors who advise you on your investments may be experts in trading securities, however, you also need to understand such investment advice and investments in your account. You have the right to ask questions about the financial product that you invest in, the risks involved, why the product is right for you, how the investment works etc. until you are certain that you fully understand the investment. This will help you to invest wisely and avoid disputes with your investment advisor and the broker firm.

Remember your investment is your responsibility too – after all it’s your hard earned money at stake.

(The writer is a capital market compliance professional with over 10 years of combined experience in commercial law and compliance in the financial services industry. She is an Attorney-at-Law and the Head of Compliance of a reputed investment banking group in Sri Lanka. Anusha’s local and foreign employments and professional affiliations include reputed Sri Lankan financial services groups, US Securities and Exchange Commission (Office of Compliance Inspections & Examinations) and State Street Global Advisors, US Anusha has a LL.B Second Class Honours (Upper) Degree from the University of Colombo, LL.M in Commercial Law from the University of Melbourne, Australia and a Fellowship in Finance and Banking from the University of Boston, USA.)

www.ft.lk

However, the investors have not only the rights but also the responsibilities in investing. The informed investors who are aware of their rights and responsibilities in investing are better able to prevent disputes with their broker firms and also reduce the risk of losing their investment portfolio due to fraudulent activities that can occur in the securities industry.

The following are some of the best practices that every investor needs to adhere to when investing in listed securities.

1. Understand that all investment involve risk and securities investment is no exception; rather securities investment is one of the more riskier categories of investments

Every investment carries some degree of risk and greater the potential for high returns (or earning) of an investment, the greater the risks as well. If you deposit your money in a licensed bank or a financial institution, depending on the tenure you still have to take the interest rate risk and inflation risk, however, the chance of you losing your capital is remote. When it comes to the securities investments, this completely changes; you may invest in listed stocks, debentures and unit trust funds. These investments involve varying degree of risks. For example, one of the main risks is market risk; that is the capital can erode in value if the price falls down and if you are forced to sell for less than what you purchased for. For example, Rule 7.1.3 of the CSE Stockbroker Rules requires that in the event the market value of the securities pledged by you falls by 25%, the member firm should inform you to meet the shortfall by the next market day. As per Rule 7.1.4, in the event you fail to meet the shortfall on the next market day, the member firm should immediately sell the securities which have been pledged by you, in order to ensure compliance with Rule 7.1.3. Such force selling along with the market risk factor can contribute to huge losses in your account.

This can happen very often and in any market due to numerous reasons. Likewise liquidity risk, political risk etc., are some of the other risks. Therefore, knowing that all investments involve risks and understanding whether you are willing to take some risk is one of the best practices in investing responsibly. Most of the capital market broker-client disputes that happen in the Sri Lankan context are due to the investors’ lack of understanding of the risks involved in their investments or the outcome of such risks. Some of the broker firms also do not encourage detailed discussions about the risk factors thinking that such discussions would scare the investor away. However, the CSE Stockbroker Rules requires all the brokers to include a risk disclosure statement to their client agreement/ account opening form. The minimum risk disclosure that is required to be included in the agreement is “the prices of securities fluctuate, sometimes drastically. The price of a security may move up or down, and may even become valueless. It is likely that losses may be incurred rather than profits made as a result of buying and selling securities”. Many investors may have seen the risk disclosure, however pay very little attention to that. If you want to understand the risks in your investments, you should carefully read and understand these risk disclosures, request your investment advisors to explain where it is not clear to you and ask questions and take independent advice if seems necessary.

2. Know your broker (KYB) firm and your investment advisor before opening an account

The broker firms play the role of a market intermediary and are regulated and licensed by the SEC. Information about the brokers licensed by the SEC including the names of broker firms, their contact details, website links and the CEO’s name and all the brokers licensed by the SEC is given on the CSE website. Ask about the broker firm’s client compliant history and whether there are outstanding court judgments etc. Doing some research about the broker firm and its investment advisors before you invest any money with them can certainly help you avoid problems as well as certain financial losses.

Investment advisors of the broker firm who are licensed by the SEC are permitted to deal with the clients on behalf of the broker firms. It is a requirement of the SEC that only the licensed investment advisors can deal with the broker firm’s clients and the trainees should be under the supervision of a senior licensed advisor. When an investor is looking for an investment advisor to work with, it is always good to request the broker firm the opportunity to meet with several investment advisors face to face to compare them before making any decision. Ask about the work experience of the Investment Advisor, any disciplinary actions against the investment advisor by the broker firm or the SEC or CSE. Generally the broker firms allocate investment advisors to their new clients based on their availability, portfolio size, clients investment objectives, communication needs etc. One of the negative practices in the industry is that many clients do not meet their investment advisor and only communicate with the investment advisor over the telephone or through emails and do not even see their investment advisor until a dispute happens. The investors have the right to decide on the investment advisor that they like to work with(subject to the availability of such investment advisor) and therefore, you should always know your broker firm and the investment advisor in the same manner in which member firms get to know your information through know Your Clients (KYC) practices.

3. Know your investment goals and communicate them to your investment advisor clearly

One of the most important requirements for an investor is to have a clear sense of his investment goals and the timelines attached to those goals. Whilst everyone wants to earn a better return, many investors want to achieve specific financial goals such as owning a house, sending children to foreign universities, or having a comfortable retirement plan. Generally, your investment advisor should ask you for these information in order to understand your profile including your risk appetite and your investment goals before they advise you on your investments. In many countries, the investment managers and investment advisors provide a detailed questionnaire to their clients to collect these information in addition to the information collected through discussions and meetings. For example; Client Assessment Form is a basic document which asks questions on investment goals, investment experience etc. The investor needs to provide accurate information in these forms and communicate their investment objectives and their risk tolerance levels clearly to their investment advisor. It is also important to update the investment advisor when there is a material change to the status of the investor. It is always good to ask for a copy of these forms, so that you know when to update the investment advisor.

4. Learn about your account, its features and related legal documents

What we have seen in the Sri Lankan capital market industry is that many investors do not like documentation part of the relationship. Very often they compare the brokers who request for less documents and tend to open account with such brokers. However, investors need to understand that knowing the nature of the account, features of it, the authority given to the broker and also the clauses of the related documents are similarly important in investing. More often clients misunderstand or do not know what they sign for. Reading the account opening form and learning of the features of your account is extremely important so that you know how to deal with your investment advisor and also the rights and responsibilities of you and your broker.

You need to know who has the authority to make investment decisions. You can have a discretionary or non-discretionary account. If you have a non-discretionary account, that means you have the full authority to make investment decisions with regard to your account. This also means that you are responsible for the decisions you make relating to your portfolio. As per the CSE Rules, the investment advisor should receive order instructions from you to carry out any transaction in your account. The broker firm should send to you a note confirming the purchase or sale of securities by the end of the trade day. Bought/sold note can also be received in electronic form if you have given your consent to the broker for such purposes. It is your responsibility to review those confirmation notes to see whether those transactions have been carried out in accordance with your instructions and to inform the Compliance Officer of the broker firm of any disagreements immediately.

If you have a discretionary account that means your investment advisor has the authority to effect transactions without your specific instructions or without consulting you in advance about the price, type, quantity or timing of each trade as long as trades are consistent with your stated investment objectives. Therefore it is important that you clearly state your investment objectives in your authorisation. The CSE Rules require that the broker firm receives prior written authorisation from the client to effect transactions without the client’s specific instructions.

As mentioned above, it is important to understand the features of a CDS account and how the CSE rules work. In particular, credit limits, conditions attached to extended credits, interest rates, and internet trading facility are some of the notable features you need to be aware of.

On the other hand, you need to know the effect of legal documents that you sign such as credit agreement, account opening form and online trading agreements etc. These are legally binding contracts that govern the terms and conditions of your account and your investments and will be the focus in any future disputes.

5. Learn about the fees and other cost charged to your account

It is important to know all the fees and expenses that you pay with regard to investments. In Sri Lanka the broker firms do not have much authority in this regard and the fee structure is mainly decided by the SEC other than the brokerage for debt instruments and over 100 million equity transactions which are negotiable among the parties subject to a minimum. With effect from 27 June 2017 the cost applicable for equity transactions up to 100 million is 1.12% and for the transactions cost for transactions over 100 million is applied on a step by step basis. As per the CSE Rules, if you fail to make payment for securities you purchase by 9.00 hours on the settlement date, which is T+3, your broker firm can at its absolute discretion recover interest commencing from the day after the settlement date up to the date of final settlement. This is however subject to maximum of 0.1% per day. In order to avoid surprises such as huge interest charged to your account, it is always better to understand the charges and take necessary action before it’s too late. Remember, Over T+3 credit almost always comes with a cost attached to it.

6. Keep records, monitor your account and if there is a problem with your account report immediately in writing

The broker firms are required to maintain proper records of all their clients and investments, however, it is important that you maintain your own copy of your investment related documents such as a copy of the account opening form, credit agreement, letters granting discretionary authority to your investment advisor, trade confirmations and other important correspondence with the broker firm. As you make investments and trade in your account, you should receive trade confirmation for each trade which should include the transaction details required by the CSE Rules. If you are a debtor, you should also receive your monthly account statement by the 7th day of the following month. Reviewing all your transactions promptly enable you to monitor your account for any unauthorised activity. It is also important to know that the investment advisors should act in the best interest of the clients and they are prohibited from trading excessively in their clients’ accounts. If you notice any unauthorised transaction, excessive trading or an error in your account, you need to inform the Compliance Officer of your broker firm immediately and the communication should be in writing. This will help you to minimise the possible financial losses to your account and also to settle disputes if any in a timely manner. The CSE Rules require any complaint first be referred to the Compliance Officer of the broker firm, in writing, within a period of three months from the date of transactions and this time restriction is only waived by the CSE under exceptional circumstances.

7. Understand your investments and ask questions

Investment advisors who advise you on your investments may be experts in trading securities, however, you also need to understand such investment advice and investments in your account. You have the right to ask questions about the financial product that you invest in, the risks involved, why the product is right for you, how the investment works etc. until you are certain that you fully understand the investment. This will help you to invest wisely and avoid disputes with your investment advisor and the broker firm.

Remember your investment is your responsibility too – after all it’s your hard earned money at stake.

(The writer is a capital market compliance professional with over 10 years of combined experience in commercial law and compliance in the financial services industry. She is an Attorney-at-Law and the Head of Compliance of a reputed investment banking group in Sri Lanka. Anusha’s local and foreign employments and professional affiliations include reputed Sri Lankan financial services groups, US Securities and Exchange Commission (Office of Compliance Inspections & Examinations) and State Street Global Advisors, US Anusha has a LL.B Second Class Honours (Upper) Degree from the University of Colombo, LL.M in Commercial Law from the University of Melbourne, Australia and a Fellowship in Finance and Banking from the University of Boston, USA.)

www.ft.lk

Quote for the day

“You need to divorce your mind from the crowd. The herd mentality causes all these IQ’s to become paralyzed. I don’t think investors are now acting more intelligently, despite the intelligence. Smart doesn’t always equal rational. To be a successful investor you must divorce yourself from the fears and greed of the people around you, although it is almost impossible.” - Warren Buffett

Monday, 11 December 2017

Quote for the day

"Winners embrace hard work. They love the discipline of it, the trade-off they're making to win. Losers, on the other hand, see it as punishment. And that's the difference." - Lou Holtz

Sunday, 10 December 2017

The 7 Toxic Personalities That Are Destroying Your Success

A toxic personality destroys a successful career.

By Lolly Daskal

Are you destroying your own success without even knowing it?

Are some of your personalities toxic and you have no clue?

Each of us has many personas- personalities that we embody.

Some personalities are positive and others are potentially harmful--and an important element of developing self-awareness is knowing which personas to nurture and which to neglect.

Here are seven of the most common personalities that are destroying your success. Pay attention because they are toxic and harmful.

1. The ambivalent persona:

If you live in a frequent state of conflicting reactions, beliefs, or feelings toward people and experiences, learn to resolve them internally. Even if it comes from being tuned in to subtleties, ambivalence makes you come across as wavering and uncertain. Foster instead a persona that is thoughtful but decisive.

2. The negative persona:

Negativity leads almost inevitably to defeatist thinking and cynicism. Train yourself to think in positive ways instead of viewing everything from a pessimistic mindset. Look for win-win solutions.

4. The jealous persona:

People get jealous when they feel that someone else has something that should be theirs; they often blame others around them rather than recognizing their own emotions. Envy is harmful enough that it's one of the seven deadly sins--it robs you of any contentment or joy in the things you've accomplished and earned, focusing all your energy instead on what you lack.

5. The entitled persona:

When you come to believe that you deserve special privileges or treatment, that the rules shouldn't apply to you, or that you are above other people, you do set yourself apart--just not in the way that you intended. The primary effect is that it becomes nearly impossible to develop the relationships that are critical to success.

By Lolly Daskal

Are you destroying your own success without even knowing it?

Are some of your personalities toxic and you have no clue?

Each of us has many personas- personalities that we embody.

Some personalities are positive and others are potentially harmful--and an important element of developing self-awareness is knowing which personas to nurture and which to neglect.

Here are seven of the most common personalities that are destroying your success. Pay attention because they are toxic and harmful.

1. The ambivalent persona:

If you live in a frequent state of conflicting reactions, beliefs, or feelings toward people and experiences, learn to resolve them internally. Even if it comes from being tuned in to subtleties, ambivalence makes you come across as wavering and uncertain. Foster instead a persona that is thoughtful but decisive.

2. The negative persona:

Negativity leads almost inevitably to defeatist thinking and cynicism. Train yourself to think in positive ways instead of viewing everything from a pessimistic mindset. Look for win-win solutions.

3. The procrastinator persona:

People like to joke about procrastination, but putting off or delaying something that requires immediate attention can be incredibly damaging. It can cause you to miss deadlines, since you don't have any pad for things to go wrong. And even if you manage to complete the task on time it's not likely to be your best work. If procrastination is an issue for you, break projects down into smaller tasks and hold yourself to a schedule.

People like to joke about procrastination, but putting off or delaying something that requires immediate attention can be incredibly damaging. It can cause you to miss deadlines, since you don't have any pad for things to go wrong. And even if you manage to complete the task on time it's not likely to be your best work. If procrastination is an issue for you, break projects down into smaller tasks and hold yourself to a schedule.

4. The jealous persona:

People get jealous when they feel that someone else has something that should be theirs; they often blame others around them rather than recognizing their own emotions. Envy is harmful enough that it's one of the seven deadly sins--it robs you of any contentment or joy in the things you've accomplished and earned, focusing all your energy instead on what you lack.

5. The entitled persona:

When you come to believe that you deserve special privileges or treatment, that the rules shouldn't apply to you, or that you are above other people, you do set yourself apart--just not in the way that you intended. The primary effect is that it becomes nearly impossible to develop the relationships that are critical to success.

6. The victim persona:

At the core of victimhood is refusing to accept your part in causing a problem and being unable to accept responsibility--instead blaming others or just refusing to acknowledge the problem. Legitimate success requires a sense of personal responsibility and accountability.

At the core of victimhood is refusing to accept your part in causing a problem and being unable to accept responsibility--instead blaming others or just refusing to acknowledge the problem. Legitimate success requires a sense of personal responsibility and accountability.

7. The perfectionist persona:

Each one of us has imperfections, whether we accept them or not. Seeking perfection in ourselves and others is destructive. It's far healthier and more beneficial to admit to our flaws and bring them into the light rather than rendering the false front of a supposedly perfect life.

The narcissist persona:

If you believe that you deserve success and you're willing to go to extreme lengths to ensure that that it happens, even at the expense of others, if you view other people as competition or threats and tend to look out only for yourself, your narcissistic tendencies are alienating the people around you. Come down to the level of reality and realize that you're no better or worse than anyone around you. Then you can relate to others and build relationships.

There are plenty of other possible personas, positive and negative. Devote some time to thinking about your own personas and how you should be dealing with them. When you successfully manage your tendencies, you'll never find yourself standing in the way of your own success. Be intentional and be successful.

Each one of us has imperfections, whether we accept them or not. Seeking perfection in ourselves and others is destructive. It's far healthier and more beneficial to admit to our flaws and bring them into the light rather than rendering the false front of a supposedly perfect life.

The narcissist persona:

If you believe that you deserve success and you're willing to go to extreme lengths to ensure that that it happens, even at the expense of others, if you view other people as competition or threats and tend to look out only for yourself, your narcissistic tendencies are alienating the people around you. Come down to the level of reality and realize that you're no better or worse than anyone around you. Then you can relate to others and build relationships.

There are plenty of other possible personas, positive and negative. Devote some time to thinking about your own personas and how you should be dealing with them. When you successfully manage your tendencies, you'll never find yourself standing in the way of your own success. Be intentional and be successful.

www.inc.com

Quote for the day

“Do not save what is left after spending; instead spend what is left after saving.” - Warren Buffett

Saturday, 9 December 2017

Humans Are Hardwired For Trading Failure

“Trading is hard”, is something we traders know already, but there are proven psychological effects that explain why the human mind is not made for trading. In the following article we will explore seven of the most popular psychological phenomena, what they mean for traders and what to be aware of when you interact with other traders.

Bandwagon Effect

Bandwagon Effect

In general:

In trading: If you are a member of a trading Skype group, read threads in trading forums or just exchange ideas with other traders, you are more likely to think that trading strategies that are popular and widely discussed must be profitable, even without seeing any sign of proof. It is therefore very important as a trader to be aware of the fact that when you read trading forums or talk to other traders, you never know the other person, their intentions and their abilities.

Herding

Ostrich Effect

The Bandwagon effect describes the phenomenon that the probability of one person adopting a belief increases based on the number of people who hold that belief. This means that if more people share a certain belief, even it is a wrong belief; it is more likely that other people will agree and also accept a group’s ideas and assumptions.

In trading: If you are a member of a trading Skype group, read threads in trading forums or just exchange ideas with other traders, you are more likely to think that trading strategies that are popular and widely discussed must be profitable, even without seeing any sign of proof. It is therefore very important as a trader to be aware of the fact that when you read trading forums or talk to other traders, you never know the other person, their intentions and their abilities.

Herding

In general: Herding explains the effect that people tend to flock together, especially in times of uncertainty or when the going gets tough. If you have to face a difficult decision or have to deal with a situation that you cannot explain, you look for other people and mimic their behavior. The rationale is that a group, especially a big group, cannot be wrong or fooled easily.

In trading: There are two negative effects for traders that exist through Herding behavior. First, Herding can be the reason for the creation of financial bubbles. When more and more people talk about a certain investment, everyone tends to believe it is a “sure thing” because “so many people can’t be wrong”. And second, if traders fail to understand the development of a market, they will flock together to come up with certain random explanations or just unanimously agree that “the markets are weird and irrational”. This ignorance and delusion of understanding will lead to further wrong trading decisions and blaming the markets instead of facing one’s own mistakes.

Information Bias

In general: The Information Bias describes the tendency to seek information when it does not change the outcome of a certain situation – more information is not always better.

In trading: The Information Bias plays a very important role in the life of a trader. When traders encounter losses, they believe it is their fault and that there are certain things he doesn’t know, but could prevent him from taking losses next time. Therefore, traders go out and buy books, read in trading forums for days and weeks and watch trading webinars without end with the goal to gather more knowledge about “how the markets and trading works”, whereas in reality, losses don’t occur because a trader knows too little. The Information Bias is, therefore, one of the main reasons for system hopping and the endless quest for the Holy Grail in trading.

In trading: There are two negative effects for traders that exist through Herding behavior. First, Herding can be the reason for the creation of financial bubbles. When more and more people talk about a certain investment, everyone tends to believe it is a “sure thing” because “so many people can’t be wrong”. And second, if traders fail to understand the development of a market, they will flock together to come up with certain random explanations or just unanimously agree that “the markets are weird and irrational”. This ignorance and delusion of understanding will lead to further wrong trading decisions and blaming the markets instead of facing one’s own mistakes.

Information Bias

In general: The Information Bias describes the tendency to seek information when it does not change the outcome of a certain situation – more information is not always better.

In trading: The Information Bias plays a very important role in the life of a trader. When traders encounter losses, they believe it is their fault and that there are certain things he doesn’t know, but could prevent him from taking losses next time. Therefore, traders go out and buy books, read in trading forums for days and weeks and watch trading webinars without end with the goal to gather more knowledge about “how the markets and trading works”, whereas in reality, losses don’t occur because a trader knows too little. The Information Bias is, therefore, one of the main reasons for system hopping and the endless quest for the Holy Grail in trading.

Ostrich Effect

In general: The Ostrich effect describes the phenomenon to ignore dangerous or negative information by “burying” one’s head in the sand, like an ostrich. Addict smokers are a good example of the Ostrich effect when they neglect the fact that smoking causes cancer and a variety of diseases – even when faced with horrible photographs on the outside of cigarette packs.

In trading: When traders find themselves in losing trades, but cannot accept that they are wrong, they will turn into ostriches. To try to outsmart the market and maybe turn a losing into a profitable trade, traders will often try to average down, which means adding new positions to losing trades – a recipe for disaster. And another common ostrich-mistake is to widen stop loss orders to delay the closing of the losing position with the hope that markets might turn around in their favor.

Outcome Bias

In general: The Outcome bias describes the fact that humans judge a decision based on the outcome, rather than how the decision was made. If you win a lot of money gambling all your net worth, it doesn’t mean that it was a smart thing to do.

In trading: The Outcome bias is a very dangerous effect for traders because it can lead to wrong assumptions about how trading works. If a trader abandons his trading plan and takes a random trade based on “gut feeling” or pure guessing, but finds himself in a winning trade, he might believe that he doesn’t need a trading plan and developed some sense about how markets move, whereas in reality, it was pure luck. Therefore, never deviate from your trading plan and always stick to your trading rules.

A ‘bad’ trade can turn into a winning trade and a ‘good’ trade into a loser. In both cases, the outcome is not based on a trader’s abilities, but on the nature of how trading works.

Overconfidence

In general: Overconfidence describes the phenomenon that some humans are too confident about their abilities, which causes them to take greater risks in their daily lives. In surveys, 84 percent of Frenchmen estimate that they are above-average lovers(Taleb). Without the overconfidence bias, the figure should be exactly at 50%.

In trading: It doesn’t matter where you listen to traders talking, you will always get the impression that 99% of all traders are chest-pounding millionaires, riding the markets up and down, whereas in reality, less than 1% of all traders can make profits. In a 2006 study, researcher James Montier found that 74% of the 300 professional fund managers surveyed judged their performance as above-average and almost 100% believed that their job performance was average or better.

Self-Enhancing Transmission Bias

In general: The Self-enhancing transmission bias explains the effect that everyone prefers to talk about success more than about failures. This leads to a false perception of reality and inability to accurately assess situations. Although it is obvious most people are no high achievers like Tiger Woods, Mark Zuckerberg, Bill Gates, or Elon Musk, average people will not talk about their failures and why they are stuck in life where they are.

In trading: The Self-enhancing transmission bias can be found especially where traders offer and sell trading strategies, systems or private trading rooms. A 2012 study by Heimer and Simon proved that individual traders are more likely to buy and follow a system if the vendor talks positively and frequently about his superior performance, even without verifying his performance. Traders who act as vendors can therefore increase their sales by purely sharing lies about their trading performance.

Conclusion: Humans Are Not Made To Be Profitable Traders

As you can see, psychology and research show that humans are not made for trading and second, that our belief system can be used against us by smart trading marketers. The takeaway message of this article is that being aware of how your brain works when trading is a key element on the way to becoming a profitable trader and it helps you avoid some of the most common trading traps.

What do you want to do next?

Source: www.tradeciety.comIn trading: When traders find themselves in losing trades, but cannot accept that they are wrong, they will turn into ostriches. To try to outsmart the market and maybe turn a losing into a profitable trade, traders will often try to average down, which means adding new positions to losing trades – a recipe for disaster. And another common ostrich-mistake is to widen stop loss orders to delay the closing of the losing position with the hope that markets might turn around in their favor.

Outcome Bias

In general: The Outcome bias describes the fact that humans judge a decision based on the outcome, rather than how the decision was made. If you win a lot of money gambling all your net worth, it doesn’t mean that it was a smart thing to do.

In trading: The Outcome bias is a very dangerous effect for traders because it can lead to wrong assumptions about how trading works. If a trader abandons his trading plan and takes a random trade based on “gut feeling” or pure guessing, but finds himself in a winning trade, he might believe that he doesn’t need a trading plan and developed some sense about how markets move, whereas in reality, it was pure luck. Therefore, never deviate from your trading plan and always stick to your trading rules.

A ‘bad’ trade can turn into a winning trade and a ‘good’ trade into a loser. In both cases, the outcome is not based on a trader’s abilities, but on the nature of how trading works.

Overconfidence

In general: Overconfidence describes the phenomenon that some humans are too confident about their abilities, which causes them to take greater risks in their daily lives. In surveys, 84 percent of Frenchmen estimate that they are above-average lovers(Taleb). Without the overconfidence bias, the figure should be exactly at 50%.

In trading: It doesn’t matter where you listen to traders talking, you will always get the impression that 99% of all traders are chest-pounding millionaires, riding the markets up and down, whereas in reality, less than 1% of all traders can make profits. In a 2006 study, researcher James Montier found that 74% of the 300 professional fund managers surveyed judged their performance as above-average and almost 100% believed that their job performance was average or better.

Self-Enhancing Transmission Bias

In general: The Self-enhancing transmission bias explains the effect that everyone prefers to talk about success more than about failures. This leads to a false perception of reality and inability to accurately assess situations. Although it is obvious most people are no high achievers like Tiger Woods, Mark Zuckerberg, Bill Gates, or Elon Musk, average people will not talk about their failures and why they are stuck in life where they are.

In trading: The Self-enhancing transmission bias can be found especially where traders offer and sell trading strategies, systems or private trading rooms. A 2012 study by Heimer and Simon proved that individual traders are more likely to buy and follow a system if the vendor talks positively and frequently about his superior performance, even without verifying his performance. Traders who act as vendors can therefore increase their sales by purely sharing lies about their trading performance.

Conclusion: Humans Are Not Made To Be Profitable Traders

As you can see, psychology and research show that humans are not made for trading and second, that our belief system can be used against us by smart trading marketers. The takeaway message of this article is that being aware of how your brain works when trading is a key element on the way to becoming a profitable trader and it helps you avoid some of the most common trading traps.

What do you want to do next?

Friday, 8 December 2017

Thursday, 7 December 2017

Quote for the day

"The greatest day in your life and mine is when we take total responsibility for our attitudes. That's the day we truly grow up." - John C. Maxwell

Wednesday, 6 December 2017

Tuesday, 5 December 2017

Quote for the day

"Almost every successful person begins with two beliefs: the future can be better than the present, and I have the power to make it so." - David Brooks

Monday, 4 December 2017

Quote for the day

"Between stimulus and response there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom." - Viktor E. Frankl

Sunday, 3 December 2017

Ethereum To Surpass Bitcoin By 2018 - Investoo Group

Before we discuss how to buy and trade ethereum we need to start in the beginning. The infographic below traces the history of Ethereum and identifies the key events that lead it to emerge as one of the most important cryptocurrencies.

Starting in 2013, the infrastructure started to be built that would allow this new coin to pose a major threat to the main 'rival': bitcoin. Let's then trace the origins and evolution of Ethereum - and lay the foundations for why, in our opinion, Ethereum is set to overtake bitcoin by 2018.

Source: http://www.mondovisione.com

Starting in 2013, the infrastructure started to be built that would allow this new coin to pose a major threat to the main 'rival': bitcoin. Let's then trace the origins and evolution of Ethereum - and lay the foundations for why, in our opinion, Ethereum is set to overtake bitcoin by 2018.

Source: http://www.mondovisione.com

Quote for the day

"The primary cause of unhappiness is never the situation but your thoughts about it." - Eckhart Tolle

Saturday, 2 December 2017

62 Insane Facts About Bitcoin

[Infographic – Updated October 2017]

Today, there are 1354 Bitcoin ATMs in 55 countries around the world and about 5.8 million users that have digital wallets. The price for one Bitcoin at the moment is $5,602 and it’s growing continuously, proportionally with the interest for digital money.

Take a look at this infographic, created by the team behind BitcoinPlay, that illustrates in details some interesting facts about this incredibly popular virtual currency.

Source: www.bitcoinplay.net

Quote for the day

"People don't have to believe in you for you to succeed. Just work hard, when you succeed, they will believe." - Stephen Keshi

Friday, 1 December 2017

Greatest Invention Yet of the Internet Age?

By Josh Wardini

Bitcoin Features

The key features that make Bitcoin so popular are plenty. First, as any single entity or government does not control Bitcoin, it is free of political instability or poor governance. As the money is stored online electronically without using a bank or person’s name, it is free from taxes or expensive fees. Furthermore, unlike fiat currencies, there is a truly limited supply, as supply is limited to mined volumes and can’t ever exceed 21 million total units. This creates a limited supply that can’t be manipulated and a scarcity-based valuation similar to a commodity.

Powering A New FinTech Sector

Not only has Bitcoin been a great invention on its own, but is responsible for spawning an entire chain of new industries. This new sector includes Bitcoin wallets, exchanges, other similar currencies and a whole network of Bitcoin ATMs that are now available in 55 countries. Furthermore, the blockchain technology Bitcoin used in its ledgering system is estimated to have the potential to save the top 10 investment banks alone, between 8 and 12 billion USD, if implemented into their systems. Another major industry rising out of the Bitcoin craze is the mining industry that actually mines or, rather. creates the currency. Some of the biggest among these mining operations can be found in China. Chinese mining pools control around 81% of Bitcoins collective hash or mining rate.

Considering that 100 USD invested into Bitcoin in July 2010 would be worth over $6 million in today’s market, Bitcoin is a clear winner and likely the Internet age’s best invention yet.

As Bitcoin surges to break high after high, it is generating more and more awareness as the world’s first Internet-based currency. Bitcoin, created in 2009 by Japanese inventor and Nobel peace prize nominee Satoshi Nakamoto, is becoming a household name. Bitcoin represents the first-ever truly global currency and is quickly being adopted by people everywhere. Bitcoinplay.net facts tell us that Bitcoin is changing the entire financial system, empowering the people and redistributing power, once conventionally held by governments and central banks, back to the free markets and people.

Bitcoin Features

The key features that make Bitcoin so popular are plenty. First, as any single entity or government does not control Bitcoin, it is free of political instability or poor governance. As the money is stored online electronically without using a bank or person’s name, it is free from taxes or expensive fees. Furthermore, unlike fiat currencies, there is a truly limited supply, as supply is limited to mined volumes and can’t ever exceed 21 million total units. This creates a limited supply that can’t be manipulated and a scarcity-based valuation similar to a commodity.

Powering A New FinTech Sector

Not only has Bitcoin been a great invention on its own, but is responsible for spawning an entire chain of new industries. This new sector includes Bitcoin wallets, exchanges, other similar currencies and a whole network of Bitcoin ATMs that are now available in 55 countries. Furthermore, the blockchain technology Bitcoin used in its ledgering system is estimated to have the potential to save the top 10 investment banks alone, between 8 and 12 billion USD, if implemented into their systems. Another major industry rising out of the Bitcoin craze is the mining industry that actually mines or, rather. creates the currency. Some of the biggest among these mining operations can be found in China. Chinese mining pools control around 81% of Bitcoins collective hash or mining rate.

Considering that 100 USD invested into Bitcoin in July 2010 would be worth over $6 million in today’s market, Bitcoin is a clear winner and likely the Internet age’s best invention yet.

Source: www.bitcoinplay.net

Quote for the day

"Talented people almost always know full well the excellence that is in them." - Charlotte Bronte

Subscribe to:

Comments (Atom)